Earlier this year, we wrote an article on the First Home Savings Account (FHSA) before we had the ability to open them. We are excited now that starting Nov. 6, 2023, we will have the ability to open First Home Savings Accounts.

Given the importance of these accounts, we thought it would be a good time for a refresher on the qualifications, limits and other important information.

Qualifications

You may qualify to open an FHSA if you are resident in Canada, you are at least 18 years old, and you are a first-time home buyer.

For the purposes of opening an FHSA, a first-time home buyer is defined as someone who has not inhabited, in the current or any of the four prior calendar years, a qualifying home that was owned by the individual or a person who is the spouse or common law partner (partner) of the individual. This mirrors the definition of a first-time home buyer for the purposes of the Home Buyers’ Plan (HBP).

Contribution limits and rules

You may contribute up to $8,000 annually, subject to any available carryforward room, and up to a $40,000 lifetime contribution limit to an FHSA.

Like a Registered Retirement Savings Plan (RRSP), contributions to an FHSA will be tax deductible, but all withdrawals to purchase a first home would be non-taxable, like a Tax-Free Savings Account (TFSA).

Indeed, an FHSA essentially combines the benefits of an RRSP and a TFSA in one account. Unlike an RRSP, contributions you make within the first 60 days of a subsequent year cannot be deducted against your income in the previous tax year, as FHSA contributions are deductible on a calendar year basis.

Like RRSP contributions, you will not be required to claim the FHSA deduction in the tax year in which a contribution is made. The amount can be carried forward indefinitely and deducted in a later tax year, which may be beneficial if you expect to be in a higher marginal tax bracket in a future year.

The maximum amount of unused FHSA contribution room that can be carried forward to a subsequent year is $8,000, which means that for any year after the year in which you open an FHSA, the maximum FHSA contribution room may be upwards of $16,000 ($8,000 carried forward contribution room plus $8,000 current year contribution room).

An FHSA is permitted to hold the same types of qualified investments that are currently allowed in an RRSP and TFSA, including mutual funds, publicly traded securities, government and corporate bonds, and guaranteed investment certificates.

You may open multiple FHSAs, but the total amount you can contribute to all your FHSAs cannot be more than your FHSA contribution room for the year.

Unlike RRSPs, you cannot contribute to your partner’s FHSA and claim a deduction. However, you can give your partner the funds to make their own FHSA contribution without the normal spousal income attribution rules applying.

Over-contributions

A one per cent penalty tax on over-contributions to an FHSA will apply for each month (or part of a month) to the highest amount of such excess that exists in that month.

When your annual contribution room is reset at the beginning of each calendar year, over-contributions from a previous year may cease to be an over-contribution.

You would be allowed to deduct an over-contributed amount for a given year in the tax year in which it ceases to be an over-contribution, but not earlier. However, if a qualifying withdrawal is made before an over-contribution ceases to be an over-contribution, no tax deduction would be allowed for the over-contributed amount.

To ensure you do not overcontribute to your FHSA, you may find the details about your FHSA contribution room on your Canada Revenue Agency (CRA) notice of assessment or reassessment.

Withdrawals and transfers

Funds withdrawn to make a qualifying home purchase are not subject to tax if certain conditions are met. First, you must be a first-time home buyer at the time of withdrawal.

Interestingly, the definition of a first-time home buyer for withdrawal purposes does not take into consideration your partner’s home ownership, which is different from the definition for the purposes of opening an FHSA, as explained above. So, even if you lived in your partner’s home before your FHSA withdrawal, you may be considered a first-time home buyer and benefit from the tax-free withdrawal to help purchase your new home.

You must also have a written agreement to buy or build a qualifying home before October 1 of the year following the year of withdrawal, and you must intend to occupy that home as your principal place of residence within one year after buying or building it. The home must be in Canada.

If you meet these conditions, the entire balance in the FHSA can be withdrawn on a tax-free basis in a single withdrawal or a series of withdrawals. The FHSA must be closed by December 31 of the year following the year of the first qualifying withdrawal, and you are not permitted to have another FHSA in your lifetime.

Any funds not used toward a home purchase can be transferred to an RRSP or Registered Retirement Income Fund (RRIF) penalty-free and tax-deferred. These transfers will not affect your RRSP contribution room, nor will they reinstate your $40,000 FHSA lifetime contribution limit. Funds transferred to an RRSP or RRIF become subject to the rules applicable to those plans. Funds can also be withdrawn from an FHSA on a taxable basis if not required for a first home purchase.

You will also be permitted to transfer funds from an RRSP to an FHSA on a tax-free basis, subject to the FHSA annual and lifetime contribution limits. These transfers would not be tax deductible and will not reinstate your RRSP contribution room.

Other important considerations

You may be able to use both the FHSA and the HBP toward the same qualifying home purchase. The HBP allows qualifying individuals to withdraw up to $35,000 from their RRSP to buy a first home. Combining the two programs, you may be able to access up to $75,000, plus growth in the FHSA, for use as a down payment on a qualifying home purchase.

Like RRSPs and TFSAs, interest on money borrowed to invest in an FHSA will not be tax deductible, and you cannot pledge FHSA assets as collateral for a loan without punitive income tax implications. In addition, FHSAs will not be given creditor protection under the Bankruptcy and Insolvency Act.

Death of an FHSA holder

As with TFSAs, you can designate your partner as the successor account holder, in which case the FHSA can maintain its tax-exempt status after death. The surviving partner would then become the new holder of the FHSA following the death of the original holder.

The surviving partner must meet the eligibility requirements to open an FHSA. The surviving partner may also transfer the FHSA on a tax-deferred basis to their RRSP or RRIF or receive the assets in the FHSA as a taxable distribution.

If the surviving partner has been designated as a beneficiary (not the successor holder) of the FHSA, they cannot become the new holder of the FHSA. They may either make a direct transfer of the FHSA on a tax-deferred basis to their FHSA, RRSP, or RRIF or receive the assets in the FHSA as a taxable distribution.

Alternatively, if anyone other than the surviving partner is designated as the beneficiary, they must include any funds received from the FHSA in their income. Finally, where there are no designated beneficiaries, the amounts from the FHSA will be distributed and taxed as income to the deceased’s estate.

Inheriting an FHSA will not generally affect the surviving partner’s FHSA contribution room. There is an exception if the deceased taxpayer was in an overcontributed position at the time of passing. In this case, the surviving partner is deemed to have contributed to the deceased’s FHSA, thereby reducing their contribution room and potentially putting the surviving partner in an overcontributed position.

If the beneficiary of an FHSA is not the deceased account holder’s partner, the funds would need to be withdrawn, paid to the beneficiary and be taxable to them.

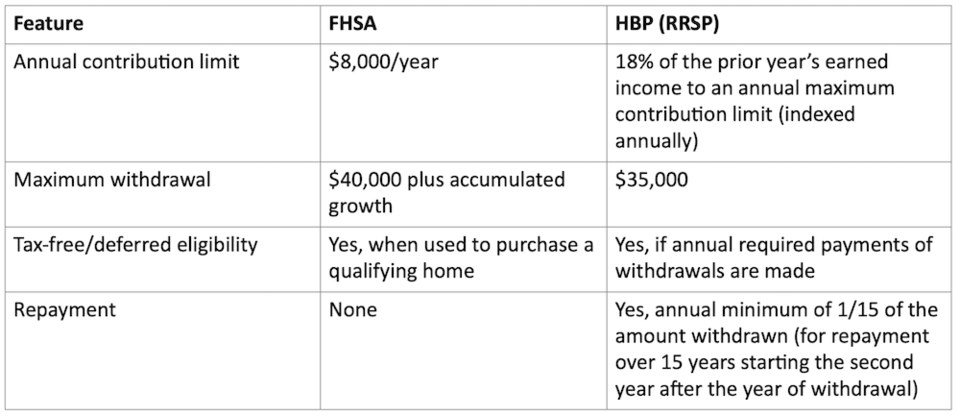

Summary comparison: FHSA vs. HBP (RRSP)

Planning

If you are eligible to contribute to an FHSA and an RRSP, you may consider contributing to an FHSA first, up to the annual contribution room of $8,000. Even if you have no intention of purchasing a home in the future, contributing to an FHSA rather than an RRSP maintains your RRSP room for future use.

If you decide not to buy a first home in the future, you may transfer your FHSA contributions plus growth to your RRSP without affecting your RRSP contribution room. Alternatively, if you contribute to your RRSP first, you can only transfer the RRSP contributions to an FHSA up to your available FHSA contribution room, and you do not get that RRSP contribution room back in the future.The FHSA may be the preferred savings vehicle if you are eligible, even if you do not plan on purchasing a first home.

If you do plan on purchasing a first home, you may consider waiting before opening an FHSA since the 15-year time limit begins upon opening the account, which may put you in a position in the future where you are required to close your FHSA before finding your first home.

Notably, the maximum annual contribution you can make to your FHSA is $16,000 if you have available carryforward room. So, if you plan to one day become a homeowner, carefully considering the account’s 15-year time limit should be factored into your home-buying planning.

Kevin Greenard CPA CA FMA CFP CIM is a Senior Wealth Advisor and Portfolio Manager, Wealth Management with The Greenard Group at Scotia Wealth Management in Victoria. His column appears every week at timescolonist.com. Call 250-389-2138, email [email protected], or visit greenardgroup.com.