On Jan. 20, 2023, we wrote our first article about the First Home Savings Account. This article is an important read if you are just gaining familiarity with this type of newly registered account. This second article offers some additional tips on how to multiply the effect of the new FHSA.

A brief refresher on the FHSA

The government implemented a few changes to assist with housing affordability in Bill C-32, which received royal assent On Dec. 15, 2022. Bill C-32 introduced a new type of registered account called the First Home Savings Account (FHSA) that entered into force on April 1, 2023.

Financial institutions utilize an outside vendor to create the systems for registered accounts. There are reporting obligations and integration with government bodies and within the financial institutions existing business.

As anticipated, it has taken time to create the systems for the new FHSA; however, as of Nov. 6, 2023, we will be able to open FHSA accounts.

How to multiply the effects of an FHSA

Below, we outline five tips to assist with multiplying the effects of the FHSA.

Tip #1: Taking advantage of the tax savings in the year of contribution.

Contributions into a FHSA can result in tax savings, resulting in having additional funds to invest. In our last article, we did not specifically note the tax savings from the original contribution that is put into a FHSA.

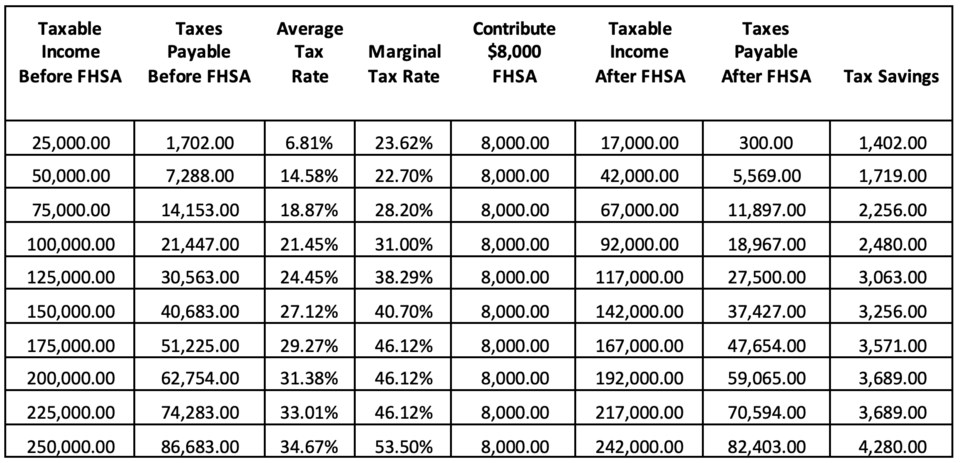

Below is a table that shows taxable income before making a contribution into a FHSA and the level of tax that is payable. Understanding marginal tax rates is key in being able to estimate the tax savings for an $8,000 contribution.

Illustrations:

Ryan’s taxable income is estimated to be $25,000 in 2023. If he contributes $8,000 into a FHSA, he will have tax savings of $1,402. If taxable income is below the amounts in the table above, we would recommend our clients first focus on funding a Tax Free Savings Account (TFSA) prior to the FHSA.

Trudy’s taxable income is estimated at $250,000 in 2023, and she would receive the maximum tax savings of $4,280 by contributing $8,000. When taxable income before FHSA is at $248,716 (top marginal tax bracket $240,716 + $8,000) the marginal tax rate is 53.5 per cent.

Tip #2: Contributing to an FHSA early results in you benefiting from compounded growth (essentially income on income — all tax free).

2023 is a bit different as it is the first year and the FHSA did not come into force until April 1, 2023. Even when it came into force, financial firms needed to create the systems to facilitate the new FHSA.

We are encouraging our clients who opened up FHSA accounts this year to contribute in November 2023 or December 2023. As the contribution maximum limit of $8,000 is based on the calendar year, we will encourage most qualifying clients to also contribute as early in 2024 (if possible).

By utilizing Tip #1, the tax savings can immediately be used to contribute to the FHSA in the following year.

Illustration:

William projects that he will make $100,000 for 2023. He is planning to contribute $8,000 into an FHSA in December 2023. This will result in him saving $2,480 in taxes. He will use the tax refund he receives in early 2024 to assist with funding the next contribution he plans to make in March 2024.

Tip #3: Ensuring the funds are invested appropriately is a key component.

If you will not be purchasing a home for many years, we encourage putting the funds into equity investments that will have the opportunity to grow and compound over time. We do not recommend leaving the funds in cash if the time horizon is longer term. We also do not recommend investing in speculative investments where the underlying capital could be at risk.

As the time horizon gets closer to where you know you may realistically make an offer on a place, then suitability and liquidity of investments are important. If you feel that you are within 12 months of purchasing a home, we recommend putting funds into an Investment Savings Account (ISA).

Currently, the rate is 4.9 per cent, is fully guaranteed, and liquid within one business day. The ISA rate is typically higher than a cashable Guaranteed Investment Certificate (GIC).

If you know that it will be more than one year, but less than three years, you could consider putting the funds into a short term GIC. To get a GIC that is paying a higher yield than an ISA, you will typically have to lock this in for a specific period, such as one or two years.

Our recommendation if you need liquidity is to focus on the ISA accounts when you get within a reasonable range of possibly making an offer.

Tip #4: Make sure adult children are opening the correct types of accounts (TFSA or FHSA) and investing the funds in a prudent manner.

Recommending they go see a Portfolio Manager by themselves can be problematic as the minimum household size is not typically reached (a minimum of $250,000) for full-service brokerage (i.e. Scotia Wealth Management).

The alternative is to invest in either a GIC or mutual funds at a bank or credit union. Many of our clients assist their children financially with the purchase of their first home, whether this be done through a loan or a gift.

Another way that clients can assist their adult children is to guide them in making good choices with the money they earn.

We wrote an article, How a Portfolio Manager helps families. We make a commitment to our clients that if any family member also needs assistance, we will help them. We discuss the term householding with them.

As the article highlights, we can link family member accounts, such as their parents, siblings, adult children, and other family member (even if they reside in different addresses). This helps reduce the cost of investing for all members of the family. Most importantly, all members of the family can get access to a qualified Wealth Advisor or Portfolio Manager.

Tip #5: Both people in a couple should take advantage if they can.

This is a key planning component as it essentially enables couples to multiply the FHSA limits by two.

Since writing our initial article, we received several emails and questions from couples regarding spouses and the FHSA and thought that we would answer the most common questions in more detail below.

How is my first-time home buyers status impacted by my spouse or common-law partner’s situation?

If you live in a house with your common-law partner (which is in their name), then you would not be considered a first-time home buyer. As a result, you would not be a qualifying individual and will not be permitted to open an FHSA.

An important point to note above is that the first-time homebuyer component only applies at the time an FHSA is initially opened. If you move into a common-law partner’s house after you have begun an FHSA, you may still contribute and do not have to close the existing FHSA. The qualifying criteria applies only when the account is first opened.

If I contribute to my spouse’s FHSA, will I be able to claim the related tax deduction?

Unlike the Tax Free Savings Account, only the owner of the FHSA can contribute to their account. In this case, only the individual’s spouse or common-law partner, would be permitted to contribute to their own FHSA. In addition, only the owner of the FHSA can claim the tax deduction for their own contributions.

Can I transfer funds from a regular RRSP into a FHSA?

Provided you have the FHSA room ($8,000 annual maximum and $40,000 lifetime maximum), you are permitted to transfer a maximum of $8,000 per year from your RRSP into a FHSA.

It is important to note that RRSP withdrawals are normally fully taxed; however, this would be considered a transfer and not a withdrawal. The RRSP transfer would not be taxed, and you would also not get the deduction for putting the funds into the FHSA.

Future growth in the money once in the FHSA would be tax free.

Can I transfer funds from a spousal RRSP into a FHSA?

With a spousal RRSP, your spouse or common-law partner originally put money into the Spousal RRSP that is in your name; however, your spouse received the tax deduction. Attribution rules would apply on any withdrawals or transfers done within the year of the contribution into the spousal RRSP or the previous two calendar years.

For 2023, if the amounts within the spousal RRSP were contributed in 2023 or the previous two calendar years (2022 and 2021) then the attribution rules would apply to any transfers to the FHSA. This essentially means that the original contributing spouse would be taxed on the amount transferred.

If the spousal RRSP contribution was done in 2020, or earlier, then it is possible to transfer a spousal RRSP into a FHSA, similar to a regular RRSP noted above.

Can I name my spouse the beneficiary of my FHSA?

Our recommendation for couples where each opens an FHSA, is to name each other as successor holders (some exceptions apply). Upon the death of the original FHSA holder, the named successor holder would become the new owner of the FHSA, provided the surviving spouse meets the eligibility criteria to open an FHSA.

Similar to a Tax Free Savings Account, when you are named the successor holder of an FHSA, it would not impact the surviving spouse’s FHSA contribution limits.

Can I name someone other than my spouse as the beneficiary of my FHSA?

Yes, you can name your estate, charity, or another individual as the beneficiary of your FHSA. For tax purposes, any amounts paid to a named beneficiary (if not the spouse) would be included in the income of the beneficiary, or taxed within the deceased’s estate if the estate was named the beneficiary or if no beneficiary was named.

If my spouse and I are not able to open a FHSA in 2023 (the first year), are we each able to contribute $16,000 ($8,000 for 2023 + $8,000 for 2024) next year when we open a FHSA in 2024?

With the Tax-Free Savings Account (TFSA), individuals who did not contribute the $5,000 in 2009 were able to carry forward this limit to future years. Adults today that reached the age of majority in 2009, and have been resident in Canada since that time are able to contribute $88,000 into a TFSA for 2023. This is essentially the sum of all the annual contribution limits between 2009 to 2023.

With the FHSA, the annual maximum is $8,000 with no carryover ability. If an individual does not contribute to the FHSA in 2023, they are not able to contribute $16,000 in 2024. The 2024 maximum contribution limit will remain at $8,000.

Kevin Greenard CPA CA FMA CFP CIM is a Senior Wealth Advisor and Portfolio Manager, Wealth Management with The Greenard Group at Scotia Wealth Management in Victoria. His column appears every week at timescolonist.com. Call 250-389-2138, email [email protected], or visit greenardgroup.com.