Strong demand for real estate in Greater Victoria over the past year means property owners on the Island are likely to see increases of as much as 10 per cent in their annual property assessments, which should start hitting Island mailboxes this week.

B.C. Assessment, which has mailed out more than 378,000 Island assessments and more than 2.1 million provincewide, said capital region homeowners can expect their 2021 assessment to reflect a real estate market left relatively untouched by the pandemic.

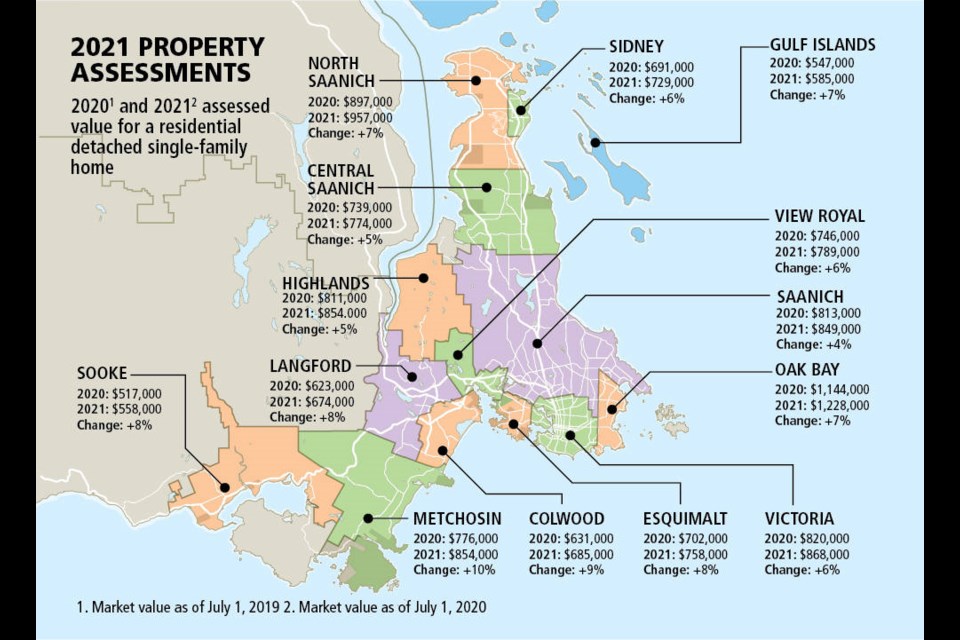

“Home values across Vancouver Island have appreciated this year due to strong demand combined with limited inventory for sale,” said Island assessor Tina Ireland. “For most communities, the assessed values of single-family homes are up moderately, about five to 10 per cent, while residential stratas are generally showing less of an increase.”

Casey Edge, executive director of the Victoria Residential Builders’ Association, said the assessment roll is a reflection of the lack of housing inventory, which has driven prices higher.

“The assessed values reflect home prices from six months ago and prices have been increasing since that time,” he said.

Edge said from the homebuilders’ perspective it’s rezoning that is limiting new supply and the answer may be for municipalities to be more open to rezone to add density in the form of duplexes and townhomes and other multi-family projects on what is becoming very expensive land.

Edge said doing that might start to alleviate pressure on existing inventory and create more affordable housing options.

Sandi-Jo Ayers, president of the Victoria Real Estate Board, said the assessment roll rarely has an effect on the marketplace as it is a snapshot of the market six months earlier.

“In real estate it’s about what is happening in the present that dictates where a willing buyer and willing seller meet in a normal market,” she said.

The fact most homes increased in value over the previous year, and low interest rates, could spur those with a lot of equity in their homes to consider making a move because of their assessment. “But the key is if they are going to sell, where are they going to buy?” she said.

No municipality in the capital region saw the typical assessed value of single-family homes or strata properties drop this year.

Last year at this time, the Crown agency reported values of typical single-family homes had dropped by as much as six per cent and strata units by as much as 10 per cent in some municipalities.

This year, the greatest increase in assessed value was 10 per cent in Metchosin, where the typical single-family home was valued at $854,000 as of July 1, 2020.

The greatest increase on the Island was in the village of Tahsis, where a typical home increased in value by 36 per cent to $135,000.

Other small Island communities saw big increases, with Zeballos seeing an 18 per cent jump to $69,000, Gold River 17 per cent to $212,000 and Port Alice up 12 per cent to $153,000.

A typical strata unit’s assessed value varied on the Island, from no change in Saanich to an eight per cent increase in Campbell River.

The assessment is the estimate of a property’s market value as of July 1, 2020, and physical condition as of Oct. 31, 2020. B.C. Assessment said changes in property value reflect movement in the market and can vary greatly from property to property.

To determine value, assessors take into account current sales in an area as well as the size, age, quality, condition, view and location of a property.

Changes do not necessarily mean a change to property taxes, Ireland said.

“It is important to understand that changes in property assessments do not automatically translate into a corresponding change in property taxes,” she said. “As indicated on your assessment notice, how your assessment changes relative to the average change in your community is what may affect your property taxes.”

Overall, the Island’s total assessment roll this year increased to $269 billion from $255 billion in 2020. More than $3.47 billion of the region’s updated assessment is from new construction, subdivisions and rezoning of properties.

The most highly assessed residential property in the capital region was once again James Island, at $57.98 million, up from $56.47 million in the previous assessment.

The most valuable single-family home is still 3160 Humber Rd. in Oak Bay, assessed at $13.9 million, down from last year’s valuation of $15.2 million.

Assessment notices are available online now at bcassessment.ca.

The total value of real estate in B.C. is over $2.01 trillion, up from $1.94 trillion in the last assessment. New construction, rezoning changes and subdivisions accounted for $22.1 billion of that increase.

B.C. Assessment said 98 per cent of property owners accept their assessment without an independent review, and the rate of assessment appeals has remained steady at below two per cent over the past 10 to 15 years.

Property owners may submit a notice of complaint by Jan. 31 to ask for an independent review by a property assessment review panel. The panels, appointed annually by the Ministry of Municipal Affairs, typically meet between Feb. 1 and March 15 to hear complaints.