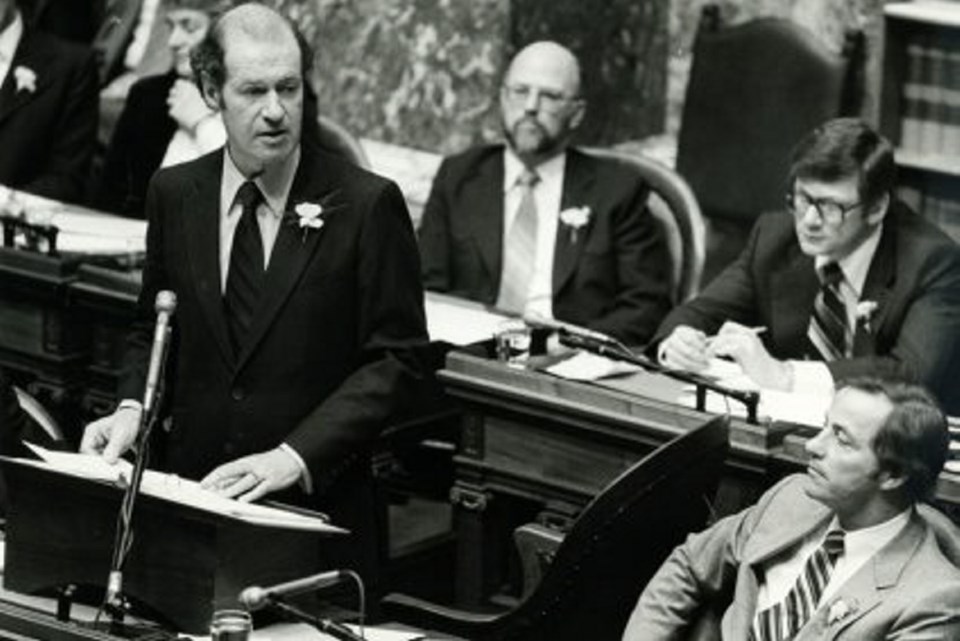

"Life has to be more meaningful for people,” finance minister Dave Barrett observed at the outset of his first budget speech in 1973.

"Life has to be more meaningful for people,” finance minister Dave Barrett observed at the outset of his first budget speech in 1973.

Injecting “meaning” into people’s lives is a pretty ambitious goal for a government budget. Most finance ministers just try to cover as many bases as they can and hope for the best. Barrett was premier as well, of course, so he had a lot more leeway in writing the speech.

As the annual public-accounts geekfest known as the budget lockup gets underway this morning, it’s a good time to review budgets of years gone by. Some of them give clues to how bright ideas can go sideways, or turn to gold.

Barrett delivered three budgets before the Socreds regained power. Their 1976 budget established the tradition observed by all new governments — blame the previous guys for cooking the books and warn that things are much worse than expected. Socreds said a purported surplus turned into a deficit, because the NDP had inflated revenues in a gamble the economy would recover from a downturn. The NDP borrowed the same move when they took over in 1991, and the B.C. Liberals did the same in 2001.

Budgets through the 1970s were pedestrian affairs. It wasn’t until 1983 that a blockbuster budget came down, the monumental restraint budget. With 20 per cent interest rates, massive unemployment and an unheard-of seven per cent decline in the GDP, then-finance minister Hugh Curtis acknowledged B.C. was at a major turning point.

His speech included a bit on the “psychology of prosperity.” B.C. had enjoyed “earned prosperity” and gotten used to “complacent prosperity.” It was “borrowed prosperity” that was unravelling.

“Unless restraint is embraced in a major way and recognition given that expenditure commitments are far beyond the ability to support, recovery could be sluggish and could collapse.” He hiked the sales tax to seven per cent from six on that basis.

Nonetheless, the planning — and spending — for Expo 86 continued. After the party, the Vander Zalm government’s first budget — a $9-billion effort compared to $45 billion today — had a sizable deficit. Then-finance minister Mel Couvelier got off one of his better lines at the time: “The easy path would have been to let the deficit increase by a few hundred million and wait for the tooth fairy to arrive.”

The precursors to the Prosperity Fund expected to be announced again today were developed back then. Couvelier announced a “budget stabilization” fund. It was hard enough to understand that it instantly became known as the BS Fund. Also set up in the late 1980s was a Privatization Benefits Fund, a stash for all the proceeds expected from an asset sell-off underway at the time. It was abandoned in two years.

Special funds have been greeted skeptically ever since. New Democrats are already referring to the “fantasy fund.”

When the NDP took over in 1991, the BS Fund was blamed for disguising a billion in debt. Then-finance minister Glen Clark responded with a round of tax hikes. The 1995 pre-election budget forecast a razor-thin $116 million surplus, but it evaporated weeks after the election and turned into a sizable deficit. The scandal ran for the rest of that term.

B.C. Liberals took over in 2001, and finance minister Gary Collins noted indignantly that things were so bad B.C. qualified for equalization payments. “It’s a downright shame that we have to take a handout from our neighbours.”

With today’s focus expected to be on housing, the most relevant budget was in 2007. Then-finance minister Carole Taylor said it was dedicated to housing. More shelter beds, an increase in income-assistance housing support, a hike in rental assistance and a $250-million housing endowment fund were all announced. There was also a new break on the property-transfer tax for first-timers that netted them $5,000 each.

It would be a good model to follow, except for one thing. The 2007 budget was one of the richest in history, over a billion dollars to the good, and building toward a $2-billion surplus the next year. Today, housing problems are much worse, but there’s a lot less revenue around to address them.