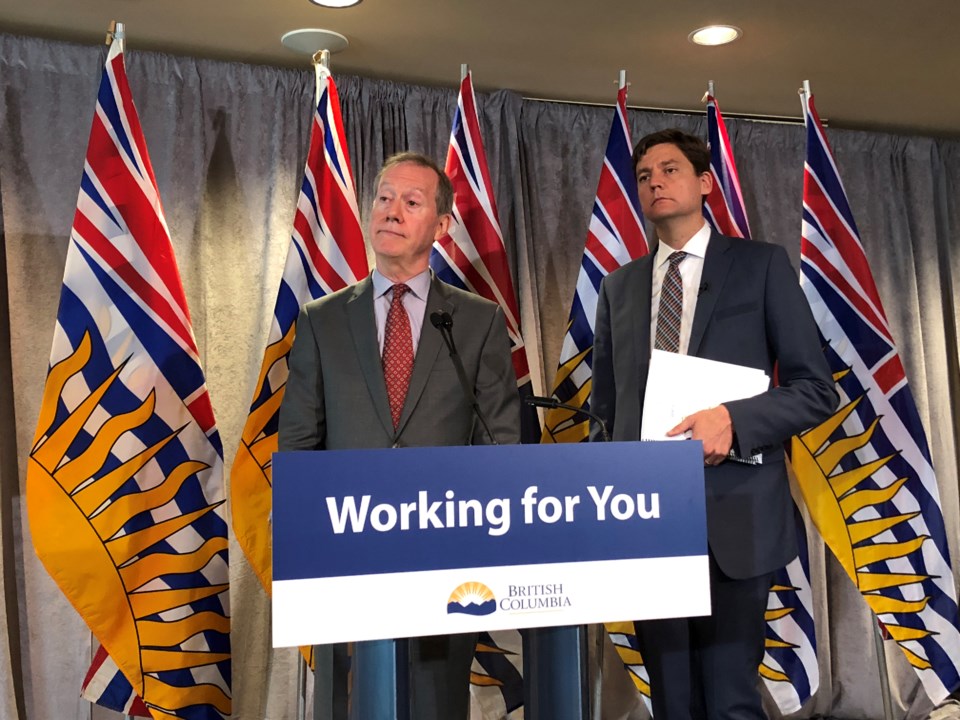

Proceeds-of-crime expert Peter German was making headlines last year about the extent of money laundering in B.C. He’d confirmed suspicions about B.C. casinos, where at one time the practice appeared to be rampant, and fingered sectors of the real estate market as well.

Proceeds-of-crime expert Peter German was making headlines last year about the extent of money laundering in B.C. He’d confirmed suspicions about B.C. casinos, where at one time the practice appeared to be rampant, and fingered sectors of the real estate market as well.

He also turned his attention to the resale market for luxury vehicles. Those flamboyantly expensive vehicles are part of the gangster lifestyle but can also be money-makers in their own right. An individual can recruit a “straw buyer” to put down a six-figure sum for a vehicle. They drive it off the lot and hand it off to the real buyer, who sells it offshore, i.e., China, where the vehicles are generally worth far more.

The cutout is needed because dealers don’t generally sell to known resellers in offshore markets.

What brings the practice to the attention of officials is the fake buyer’s application for a provincial sales tax rebate. They’re eligible if they apply within seven days, or if they can show it was purchased for resale.

In response to a freedom of information request, the government released a trove of memos about the practice. One of the takeaways is that for all the suspicions raised by German, the practice is not illegal.

Anyone can do this. It feels, looks and smells dirty, mostly because German dwelled on the number of cash transactions. But there’s no law against it.

Finance ministry briefing notes last year say so many applications were coming in that officials are swamped and there’s a four-month waiting list.

“While the large volumes of PST refund claims for PST paid on luxury vehicles purchased, resold and exported has resulted in a significant workload for the ministry in the past five years, these refund claims have not included specific evidence of criminal activity.”

If you buy a car and resell it within seven days, you’re entitled to a PST refund. If you have a PST registration number and wouldn’t even pay the tax. But you can still get the refund if you sell it within a week, or somehow prove it was bought just for resale.

The briefing notes say that before 2014, refunds were so rare the ministry didn’t even track them. But officials noticed then a big volume of refund applications from people who bought cars then sold them for the purpose of exporting them. The tracking started and it shows the practice grew rapidly.

From 750 in 2015, it grew to 3,600 applications in 2016 and 2017. Then 4,452 in 2018. The median refund was about $7,800. Common brands were Mercedes-Benz, Land Rover, BMW, Maserati and Lamborghini.

The total value of the refunds increased at the same pace, from $5 million in 2015 to $28.5 million in 2018.

Officials observe that resellers are regularly using what German called straw buyers to buy the vehicles, to the point that the same names are showing up on multiple deals.

The refund cheques are even sent directly to the resellers, though they’re made out to the fake buyers.

“From a PST refund perspective, neither of these observations are problematic or off-side of the criteria for receiving refunds,” said one memo.

The ministry notes say the individuals often struggle with the documentation, but the resellers help them with the paperwork, which smoothes the process.

The fake buyers are paid for the services and that income is taxable, so the officials have shared the information with the income taxation branch. “Nothing further has been done with this information yet,” said one briefing note from last April.

Various officials met with German last January and there was talk of legislative changes that might curtail the practice, but the note said the changes “have not been fully explored” with legal services or tax policy branches.

Just So You Know: It will likely take until the end of the public inquiry into money laundering to see what the government does about the offshore reselling racket. But that’s going to be an expensive wait.

More than $73 million worth of refunds have been sent out in the past five years, and the ministry had to hired six extra staff to make sure the fakers are getting their refunds promptly.