Japan’s benchmark Nikkei 225 index surged Thursday past the record it set in 1989 before its financial bubble burst, ushering in an era of faltering growth.

The index closed Thursday at 39,098.68, up 2.2%. It had been hovering for weeks near 34-year highs. Its previous record was 38,915.87, set on Dec. 29, 1989.

That was more than a generation ago at the height of Japan’s post-war boom.

After the peak, as banks wrote off some 100 trillion yen in bad debts, shares meandered well below the record for many years — dipping below 8,200 in 2011 after the triple disasters of a massive earthquake and tsunamis and meltdowns at the Fukushima Dai-Ichi nuclear power plant in northeastern Japan.

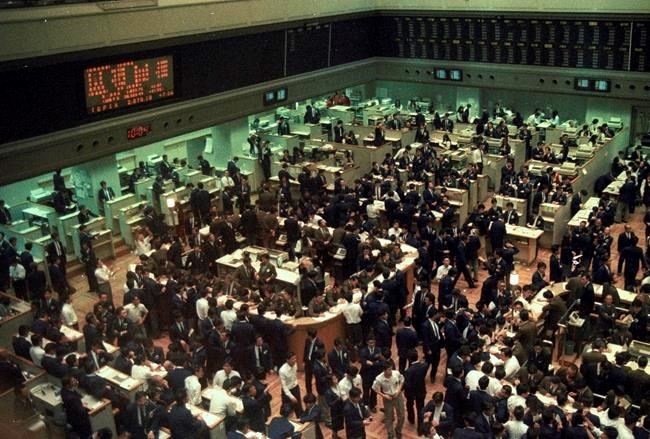

But the market has logged sharp gains in recent months, helped by strong interest from foreign investors who account for the majority of trading volume on the Tokyo exchange.

Unlike in the United States, where shares have been topping records on hopes the Federal Reserve will begin cutting high interest rates once it decides inflation is truly under control, in Japan the benchmark rate has remained at minus 0.1% for over a decade.

News that the economy slipped into recession in late 2023 has raised hopes that the Bank of Japan will stick to the easy money policies it has been using to try to spur inflation and push growth higher.

Plenty of the money the central bank has pumped into the economy has found its way into the stock market. And many global investors have been shifting their portfolios away from China as its economy slows and tensions flare between Washington and Beijing.

Share prices in Tokyo have risen 15% in the past three months and about 44% in the past year. In Shanghai, prices have fallen more than 11% from a year ago, while Hong Kong’s Hang Seng index is down about 22%.

Record gains in corporate earnings for Japanese companies and improved corporate governance have enhanced the appeal of shares in Japanese companies, analysts say.

“As Japanese companies show signs of change I think investors are taking a closer look,” Hiromi Yamaji, group CEO of the Japan Exchange Group, said in an online briefing Wednesday sponsored by The Financial Times.

He noted that while many older Japanese are reluctant to invest in shares after the trauma of losing their savings when the bubble burst in the early 1990s, younger investors are less wary.

“The generation is changing,” Yamaji said.

Elaine Kurtenbach, The Associated Press