Property sales in the capital region rose about 15 per cent last month from June of 2022, as the real estate market returns to a more traditional pattern that follows the seasons, said Victoria Real Estate board chair Graden Sol.

“During and shortly after the pandemic, we couldn’t rely on our usual comparisons to explain the market,” Sol said. “This year we have seen a return to a seasonal pattern, where the sales are slower through the winter and may peak in the spring.

“This seasonal trend is generally followed by a summer market which remains stable but is not as highly active.”

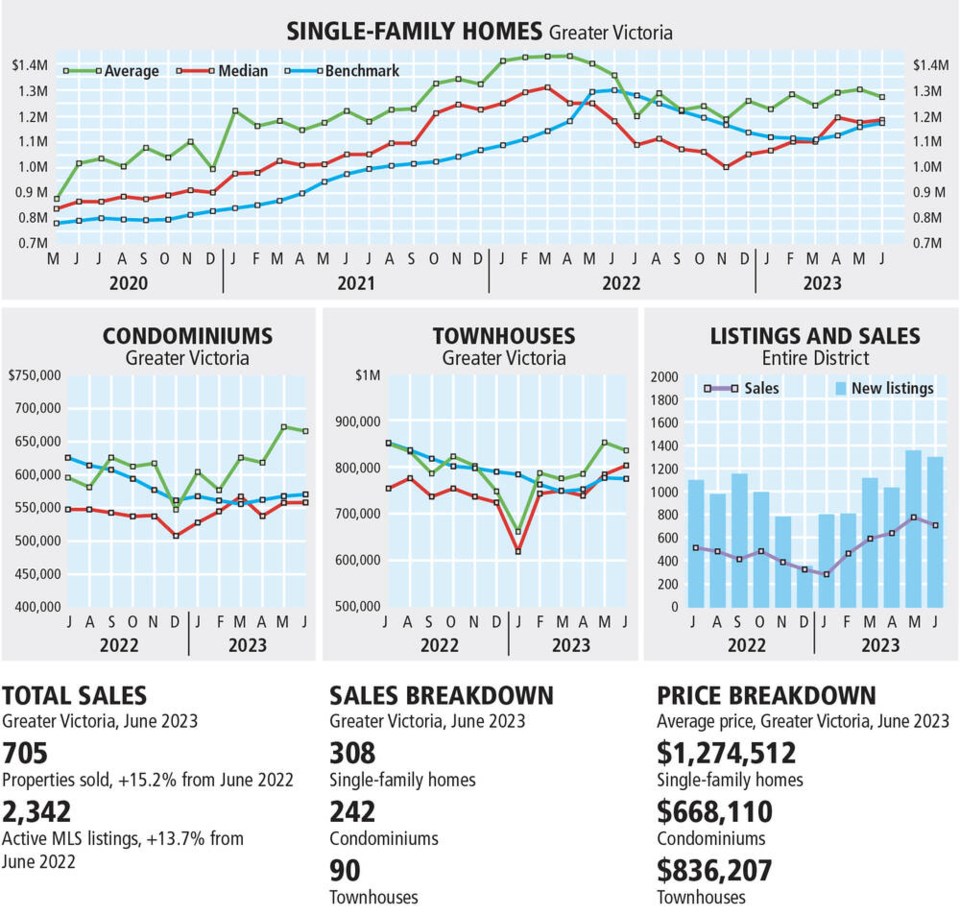

A total of 705 properties sold in June, up from 612 in June of last year, although June sales dipped by nine per cent from May of this year, the real estate board said in its monthly sales report released Tuesday.

Of last month’s total sales, 673 were for residential properties. The rest included lots, acreages and commercial properties.

The total value of all properties sold last month came to $668.39 million, up from a $622.58 million in June 2022.

Condominium sales rose almost 20 per cent in June from the same month last year, with 242 units sold.

Single-family home sales also rose, with 322 homes sold, up by 6.6 per cent from June of last year.

The benchmark price for a single-family house in the Victoria core area was $1.3 million last month, down from $1.4 million in June 2022. May’s benchmark price was $1.29 million.

The core refers to Victoria, Saanich, Oak Bay, Esquimalt and View Royal.

For condominiums, the benchmark price in the core was $573,800 in June, down from $615,200 in June 2022. May’s benchmark was $569,300.

At the end of June, 2,342 listings were available through the board, up by 13.7 per cent from the same month in 2022.

Higher inventory rates are welcomed by the board, although Sol noted that available listing numbers are low compared to historic numbers.

But if inventory climbs, prices may stabilize further due to a larger supply, he said.

“Well-priced properties are still selling rapidly, while benchmark pricing remains reasonably level.”

>>> To comment on this article, write a letter to the editor: [email protected]