Continued strong demand for homes in the region has the Victoria Real Estate Board bracing for another year of fast-paced transactions and higher prices, based on sales figures released Tuesday.

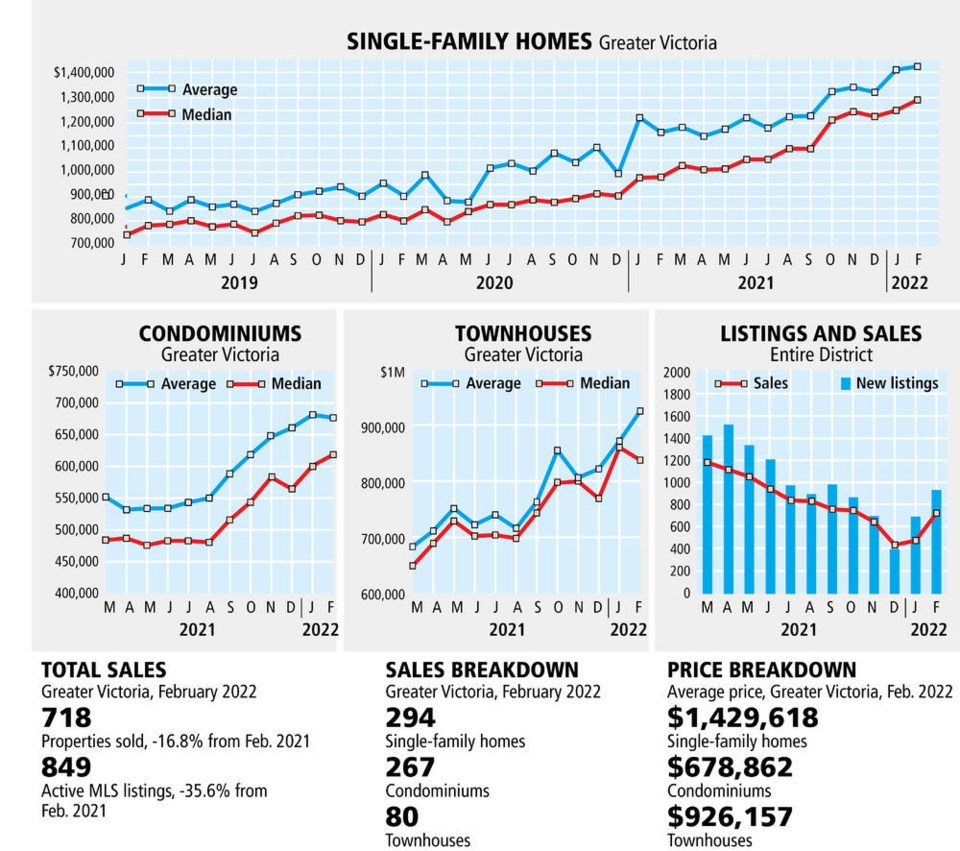

The number of home sales last month jumped to 718 from 474 in January, while the benchmark price for a single-family home in Greater Victoria hit $1.1 million, up from $1.085 million in January and $859,600 in February 2021.

The benchmark price of a condo also jumped last month to $597,700 from $487,400 at the same time last year, while the townhome benchmark increased to $786,100 from $623,900.

Karen Dinnie-Smyth, president of the board, said people should expect those trends to continue, if inventory levels don’t increase significantly.

“If [they] don’t, then we are potentially going to see the same market,” she said.

Last year, strong demand coupled with low inventory led to available homes being snapped up quickly when they hit the market, often in multiple-offer scenarios with the final sales price being well over the asking price.

According to research by Nicole Burgess of Pemberton Holmes, 58 per cent of the single-family homes that changed hands in the core sold for more than the asking price. Of the 8,640 sales in the region last year, 4,248 went for over the asking price, with buyers spending a combined $254 million above asking.

Dinnie-Smyth said the industry has asked the province for new measures to improve supply and bring the market back into balance from the overwhelming seller’s market it has been for the last few years. “We need incentives for gentle densification and the removal of municipal barriers to development,” she said. “What government has chosen to focus on instead is their announcement of a cooling-off period for residential sales this spring.”

The cooling-off initiative would, in theory, give buyers a limited amount of time to change their minds and cancel a purchase with little or no legal consequences.

The Victoria Real Estate Board and the British Columbia Real Estate Association have recommended against a cooling-off period, saying their research indicates it will add volatility in both slow and pressurized market conditions.

Dinnie-Smyth said the measure would create more risk and uncertainty for home sellers, and give experienced and well-funded buyers an advantage over first-time buyers because it reduces negotiations to price alone.

Both the Victoria board and the BCREA have recommended alternative ideas for consumer protection, including a pre-sale offer period that would see a property listed for a set period of time before offers would be accepted, giving buyers a chance to research a property before making an offer.

Dinnie-Smyth said the pre-sale offer period would give the public the same protections, without tying up the property.

“So you would have the house on the market for [a certain] amount of days before offers come in, that then gives people the opportunity to do their due diligence,” she said.

It also means pre-emptive, or bully offers — offers that come in ahead of a deadline and are designed to be more attractive to a seller and eliminate competition — would be eliminated.

“So everybody is equal,” said Dinnie-Smyth. “And then you go to the offer date with everybody having had equal opportunity.”

Dinnie-Smyth took issue with Finance Minister Selina Robinson’s suggestion this week that the industry may have a vested interest in the market being hot.

“For Minister Robinson to suggest that realtors are keeping prices high is a convenient excuse and a weak attempt to divert attention away from the real issue — supply,” she said. “Realtors would prefer a balanced market with reasonable prices and plenty of housing supply to meet demand. Our realtors’ only vested interest is in their clients and the more balanced our market is, the better we are able to serve the needs of buyers and sellers.”

There was a tiny step toward a more balanced market in Greater Victoria last month, as the board recorded a slight increase in inventory.

Active listings available at the end of February increased to 849 from the 744 available at the end of January, although that’s still well below the 1,318 available at the same time last year.

“It was heartening this month to see some more listings come to market in February,” said Dinnie-Smyth.

“It’s typical for this time of year. Historically, spring has seen an influx of inventory onto the market.”

That hasn’t been the case in the last couple of years, however, as would-be sellers have felt stuck, with little available to buy in the same market.

Dinnie-Smyth said the difference this year is an injection of optimism. “People are feeling that COVID is [waning] and they can safely put their houses on the market, and I’m sure there’s some people that are seeing the pricing is attractive, especially if they are downsizing,” she said.

To comment on this article, write a letter to the editor: [email protected]