Within seconds of the noontime announcement by the U.S. central bank that it was taking yet more extraordinary measures to rescue the American economy, the news hit home in Canada.

Immediately stock markets and the loonie started to climb, the latter easily surpassing another milestone above $1.03 US.

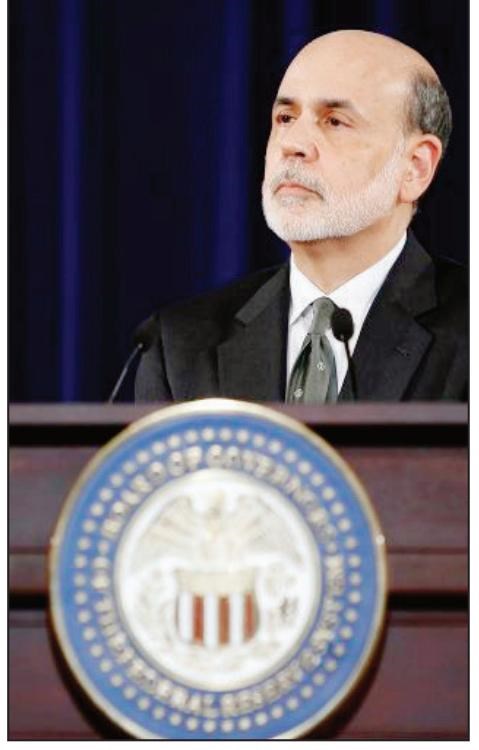

The rally was somewhat remarkable given that the move had been long telegraphed, but it also demonstrated how quickly and directly U.S. policy impacts its northern neighbour. Canadian economists mostly praised Fed chairman Ben Bernanke's move, but there was a variety of views of what it ultimately means to Canadians.

At the outset, there is no doubt Bernanke has made it more difficult for his northern counterpart, Mark Carney, to maintain his monetary tightening bias in the face of the U.S. central bank opening up the money spigot, they say.

Not only did Bernanke extend his current quantitative easing program, but he added to it by promising to buy up US$40 billion in mortgage-backed securities each month, and projected further - to mid 2015 - his forecast on when he might be ready to start hiking interest rates.

The U.S. dollar plunged on the news, while other currencies, including the loonie, gained momentum.

"This makes hawkish policy talk by the Bank of Canada totally inappropriate at this juncture," said Derek Holt, vice-president of economics with Scotiabank.

The Bank of Canada said there would be no public reaction to the Fed.

The Canadian central bank will be constrained, said Holt, because it will fear further strengthening of the dollar could deal a death blow to exporters.

Canada set a record for monthly trade deficits in July with a $2.3 billion shortfall, the dollar being partly blamed for making some goods too expensive in foreign markets.

That in conjunction with the air being let out of the housing bubbles in Vancouver and Toronto, Holt said the short-term risk is that the economy may stall in the upcoming quarter.

But the longer-term effect on Canada will likely depend on whether Bernanke's latest move and implied pledge to do whatever he can to boost job creation in the U.S. succeeds.

Bernanke took pains to caution his program, termed QE3 because it is his third kick at the can on quantitative easing, will help, but can't work miracles.

In particular, he cannot offset the shock of the fiscal cliff, which is what would happen if warring politicians in Washington don't get together this fall to extend programs and tax cuts helping keep the economy out of recession.

"Monetary policy, particularly in the current circumstances, cannot cure all economic ills," he said.

But Bernanke also said he believes the fiscal cliff will be avoided, and projected stronger growth for the U.S. going forward - as high as three per cent in 2013 and 3.8 in 2014.

At the very least, economists believe Bernanke has forestalled the floor dropping out of the U.S. economy. Just how much more growth he can get out of it is another question.

"My belief is that the Fed announcement is very bold, but I don't think this is a game changer. It's a positive, but economic growth in the United States will still be gradual," said TD Bank chief economist Craig Alexander.

But Alexander added if Bernanke is able to get a bigger bang for his injection of bucks, the Canadian economy would benefit from increased economic activity south of the border.

The Fed's targeting of the mortgage market in the announcement could also spark new housing starts, which would be a big boon to the hard-pressed Canadian lumber industry.

A strong U.S. economy, still the world's largest, would also have spill-over effects all around the globe, which would be a positive on prices and demand for commodities that Canada exports.

A stronger American economy would ultimately strengthen its currency as well, which would reduce the pop in the loonie to a temporary market aberration and leave few scars on export industries.

Bank of Montreal chief economist Sherry Cooper said the most important take-away from the Fed announcement is that it is willing to "use all the power it can muster" to return the U.S. economy to full employment.

> Markets, loonie rise on stimulus news, page B2