Greater Victoria’s real estate market may be singing the same tune it has been for months — the ballad of high demand and low inventory — but there is a hint of change in the air, said the head of the Victoria Real Estate Board.

Board president Karen Dinnie-Smith said factors ranging from looming interest-rate changes to new regulations for the industry and a spring break when people were actually able to travel are likely behind a lull in sales activity in a month that is usually the kickoff to the industry’s busiest season.

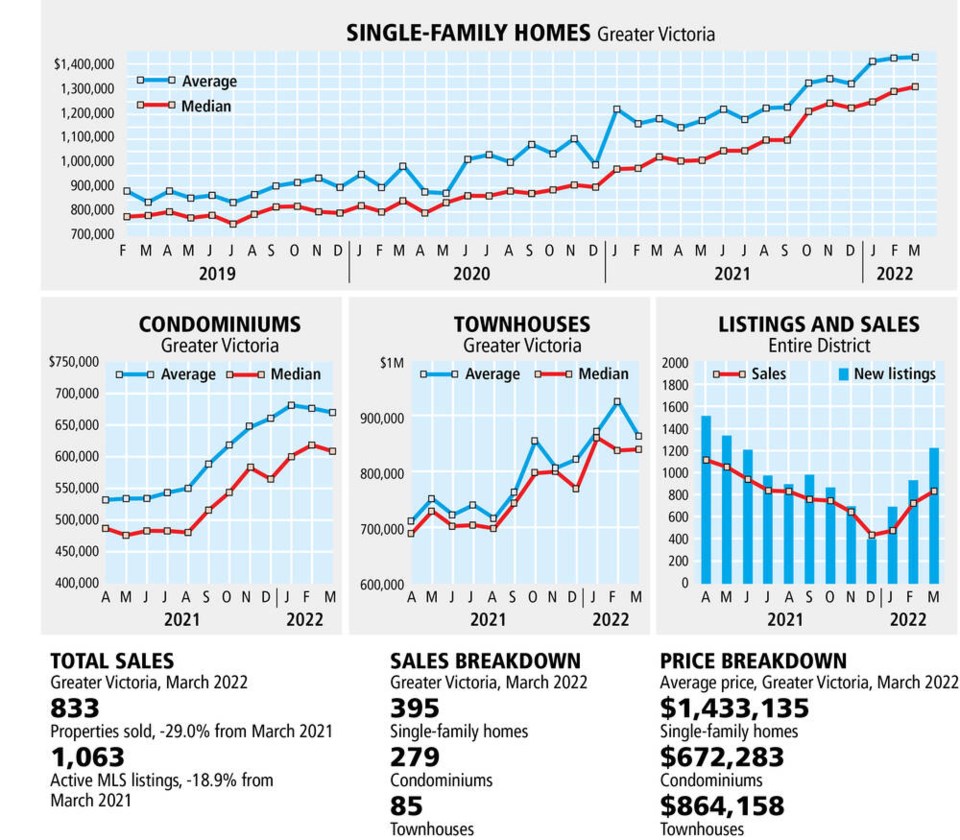

There were just 833 property sales in the region in March, down from 1,173 properties sold in March 2021.

And while lack of supply is a factor in slowing down the pace of sales, it’s far from the only one, which makes it nearly impossible to forecast where the market is heading.

“The market seems to be experiencing somewhat of a change, but it’s hard to say whether that is because it’s a spring break, the first spring break for a couple of years that people have been able to go away, or price points being at the point now where they are becoming less affordable for most people,” she said. “There are a whole bunch of things going on and the market is experiencing some change based on many outside factors.”

What isn’t changing is the lack of inventory and continued high demand for housing in the region.

There were just 1,063 active listings at the end of March, a 25.2 per cent increase over numbers in February, but still below last March’s 1,310 active listings.

And with continued high demand, prices jumped again last month, with the benchmark price of a single-family home in the region reaching $1.14 million from $1.1 million in February and $874,900 in March last year.

The benchmark price of a condo jumped to $631,100 from $492,700 last year and a townhouse jumped to $791,700 from $641,500 over the last 12 months.

Dinnie-Smith said at the lower end of the market, where first-time buyers and people new to the region tend to sit, there are still plenty of examples of multiple-offer situations and homes selling for well above asking price.

“We did see more homes come to market this month compared to February, which is a positive sign, but our supply is still so constricted that multiple offers and competition continues,” she said.

That pressure could lift if more listings come to market over the spring, but with inventory so much lower than average, there’s a long way to go to find balance, Dinnie-Smith said.

Even if builders could put everything they’re currently building on the market immediately, rising material and labour costs would still be a factor, she said. “Can they hit the market at a price point that will be reaching out to the segment of the population that we’re trying to get into the market?” she said. “That’s where we are struggling.”