The spectre of high interest rates continued to weigh down the Victoria real estate market in October, as the pace of sales activity dropped off significantly.

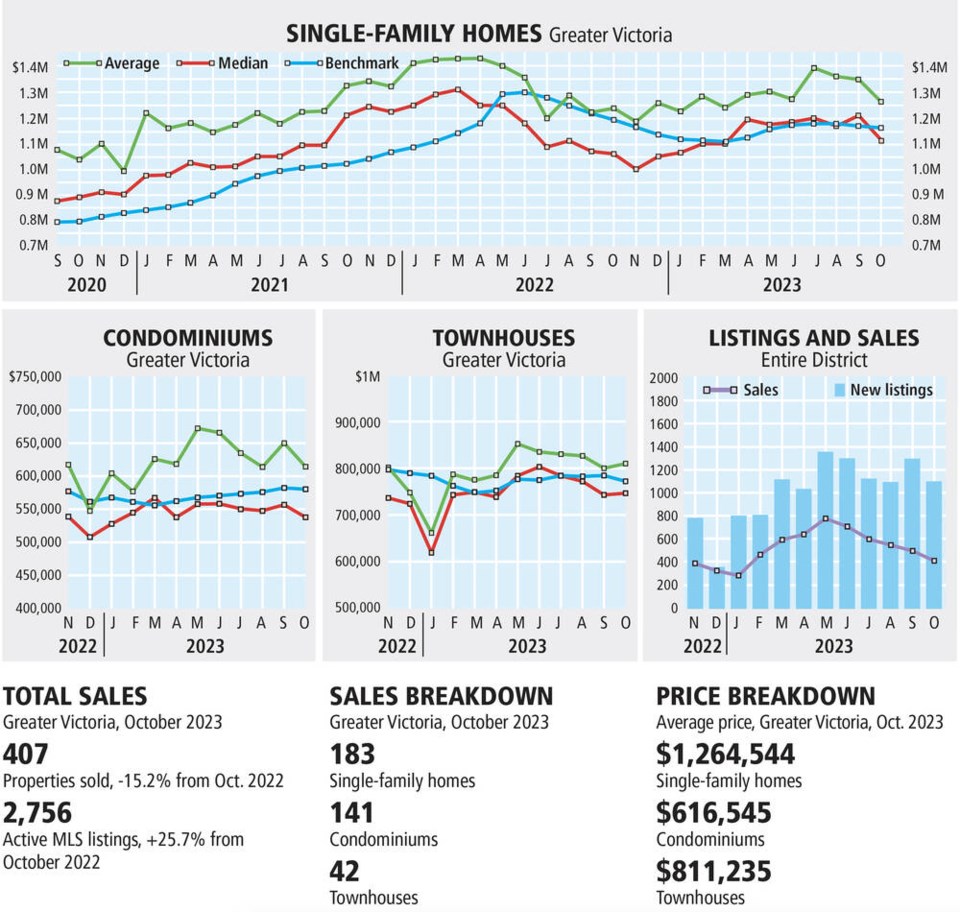

According to figures released Wednesday by the Victoria Real Estate Board, sales fell 15.2 per cent to 407 in October compared to the same time last year, and were down 17.4 per cent from September 2023.

The sales figures are well below the 10-year average of 657 units sold in October.

Graden Sol, chair of the board, said the drop is likely due to consumers having to deal with the highest interest rates they’ve seen in nearly 20 years.

“The uncertainty around the direction of the Bank of Canada rate announcement in mid-October may have caused some buyers to push their purchasing plans into the future because it was unclear if rates were going to be hiked again or remain stable,” he said.

“Generally speaking, when we have periods of static interest rates, consumer confidence returns to the market.”

The central bank held the line on interest rates in October. The bank maintained its key interest rate at five per cent, though it did not rule out future rate hikes as its latest projections show inflation remaining higher in the short term.

Sol said the interest rate clearly has an effect on the local market as sales increased when rates held steady earlier in the year, but when rates rose again, buyers’ confidence started to falter.

Last month, sales of single-family homes dropped 16.1 per cent to 193 over the last year, while condo sales dropped 7.2 per cent to 141 units over that same time period.

While the number of sales was dropping, prices weren’t.

The board’s benchmark value — which it considers a more accurate reflection of the market — for a single-family home in the region was $1.162 million in October, just a fraction below the September benchmark of $1.169 million, and up from the $1.13 million benchmark last October.

In the core — Victoria, Esquimalt, Oak Bay, Saanich and View Royal — the benchmark price for a single-family home was $1.3 million last month, compared with $1.31 million in September and $1.25 million at the same time last year.

The benchmark value for a condominium in the region in October was $582,500, a slight drop from the $584,500 mark hit in September, but up from the $574,600 benchmark in October last year.

The townhouse benchmark hit $773,100 in October, down from $785,600 in September but only a slight change from the $774,700 benchmark in October last year.

The number of active listings was also on the rise in October, with 2,756 active listings available at the end of October, up 2.1 per cent from September, and up 25.7 per cent increase from the 2,192 active listings for sale at the end of October 2022.

“This additional inventory is positive for buyers, who will have more selection than they’ve experienced in recent years,” said Sol.