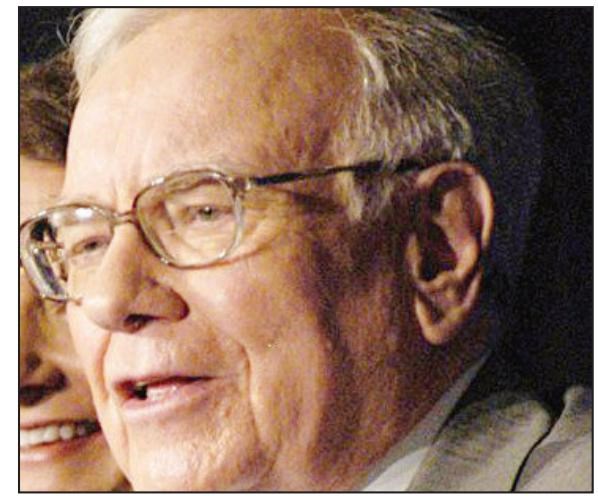

Warren Buffett's birthday this week was good news for Berkshire Hathaway investors who could celebrate another year of the Oracle of Omaha's leadership. But the milestone also reminded shareholders they need to think about who will run the evolving company after Buffett is gone.

The more than 80 businesses that Buffett has assembled at Berkshire are mostly humming along well, posting a profit of more than $3 billion in the mostrecent quarter. Its Class A stock closed at $127,183 on Thursday - less than $3 away from its 52-week high set in early August.

So there's plenty for shareholders to celebrate.

But Buffett's advancing age - he turned 82 on Thursday - coupled with his radiation treatment for prostate cancer this summer, keeps his mortality on the minds of many Berkshire investors. Buffett has said the cancer isn't life-threatening, and he is feeling good.

Buffett has outlined Berkshire's succession plan and reassured investors that his board has chosen a successor and two backup candidates, although he won't say who the company's next CEO will be. Buffett is both chairman and CEO.

Buffett has no plans to step down, saying he enjoys the dealmaking too much, even though he hasn't landed a sizeable acquisition since buying chemical maker Lubrizol for $9 billion last year.

Whoever takes over Berkshire after Buffett will inherit a sprawling conglomerate that is evolving with each new acquisition. The Omaha-based company now relies less on the insurance companies and investments it has long been known for and more on its railroad, utility and manufacturing companies.

"The insurance is increasingly more of an engine that runs in the background instead of the driver of the business," said Jeff Matthews, an investor who wrote Secrets in Plain Sight: Business & Investing Secrets of Warren Buffett.

Buffett did not respond to an interview request for this story.

Berkshire Hathaway Inc.'s second-quarter earnings report earlier this month showed that easily more than half of the company's profits come from mostly mundane companies like its electric utility MidAmerican Energy, Lubrizol, BNSF railroad, manufacturing and tool companies.

The trend has been strengthening ever since Buffett's firm acquired the Burlington Northern Santa Fe railroad in 2010, but it's even more apparent now that Lubrizol has been part of Berkshire for nearly a year.

The shift in the mix of Berkshire's businesses could make the company more attractive to investors who found the world of insurance complicated.