Rising interest rates, inflation pressure, and a dose of buyer exhaustion has slowed down what had been a white hot Victoria real estate market and turned it into a much more user-friendly experience, said the president of the Victoria Real Estate Board.

Citing new sales information released Tuesday showing just 510 property sales around the region, Karen Dinnie-Smyth said the slow down in the marketplace translates into a “calmer and more friendly environment with time for decision-making.”

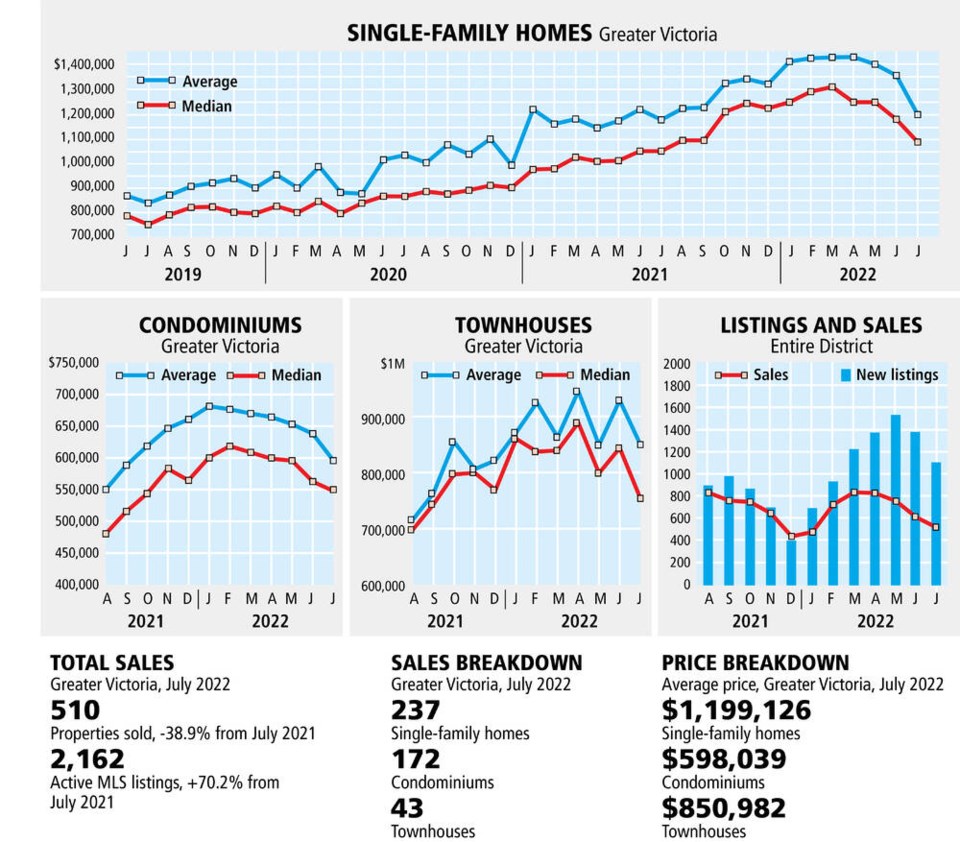

Last month, the total number of sales dropped to 510 from 835 in July last year. While it’s a big drop, the average number of sales in July over the last five years before the pandemic was 743.

Dinnie-Smyth said the biggest factor is likely interest rates.

“If you have a small jump, it doesn’t make much of a difference, but when we’ve had the increased jumps that we’ve had over the last few months, obviously that has an impact on the market,” she said.

The result is buyers have both some time to find the right home and more to choose from, two things they have not had over the last two years.

There were 2,162 active listings for sale at the end of July, a 70 per cent increase from the 1,270 active listings for sale at the end of July 2021.

Dinnie-Smyth expects to see a calmer, quieter market for the rest of this year.

“And that’s good for everybody. It gives everybody time to breathe and think about what’s going on and where they want to be and how they can get into the market,” she said, adding the market is more than just numbers.

“Values will rise and fall over time, and historically local real estate values slowly increase over time, which means despite month-to-month variations, if you are buying a home, you have a sound, long-term investment,” she said. “We need to remember that people don’t buy and sell on a month-to-month basis.”

She said when looked at in that way, and as a long-term investment for a family, the market is still good for buyers and for sellers.

Sales prices seem to suggest sellers are not hurting much.

The benchmark sale price for a single-family home in the region did slip in July to $1.28 million, down from $1.3 million in June, but it remains well above the $1.06 million in July last year.

Condominium prices in the region have also held their value, with the benchmark sale price last month hitting $628,100 in the region, down from $630,100 in June, but well above the $501,000 set in July 2021.

Townhomes are the exception, with the benchmark sale price increasing in the region last month to $852,600, up from $850,300 in June and $684,300 last July.

“But everybody has this luxury of time now to think about what they’re purchasing and to think about what they’re selling,” she said.

Dinnie-Smyth noted the slowdown has really been noticed for homes around $1 million, but in the $1.5 million-plus range things remain fairly steady.

“It has been slower, but not as dramatic as we’ve seen in that sort of million-and-under range,” she said.

Dinnie-Smyth said while sales activity may be cooling off, there’s no reason for the supply side to take a break, as it now has the chance to make up some ground.

“What we need is to still keep dealing with the supply constraints,” she said, because while the market may be levelling off, it will heat up again and there will be pressure on the housing stock as there has been for the last several years. “We know it will swing back up again and if supply drops down again, we are back into exactly the same position we were before.”

The rest of the Island also saw more inventory last month.

The Vancouver Island Real Estate Board said buyers beyond the Malahat had more to choose from as the number of single-family homes listed for sale increased 142 per cent to 1,387 compared with last year, while the available condo numbers increased 91 per cent to 336 and townhomes jumped 107 per cent to 267.

Kelly O’Dwyer, president of the board, said the pace is more reminiscent of a typical summer market.

“While higher interest rates are certainly impacting the market, some buyers are postponing their home purchase and planning to revisit the process in the fall,” said O’Dwyer. “The pandemic threw a wrench into the real estate market, but what we’re experiencing now feels more like a typical summer.”

Last month, the Island saw 297 single-family-home sales, a 34 per cent drop compared with last year, while condo sales dropped 37 per cent and townhome sales dropped 49 per cent over that same time.

Prices remains strong, though the benchmark sale price was down one per cent compared with June of this year.

But compared with last year at this time, sale prices have made big jumps, with the benchmark price of a single-family home hitting $856,700 in July, up 22 per cent from one year ago. The benchmark condo price was up 26 per cent to $450,200 last month, and the townhouse sale price increased by 23 per cent to $624,700.