Europe's fragile financial calm was shattered Wednesday as investors worried that violent anti-austerity protests in Greece and Spain's debt troubles showed that the region still cannot get a grip on its financial crisis and stabilize its common currency, the euro.

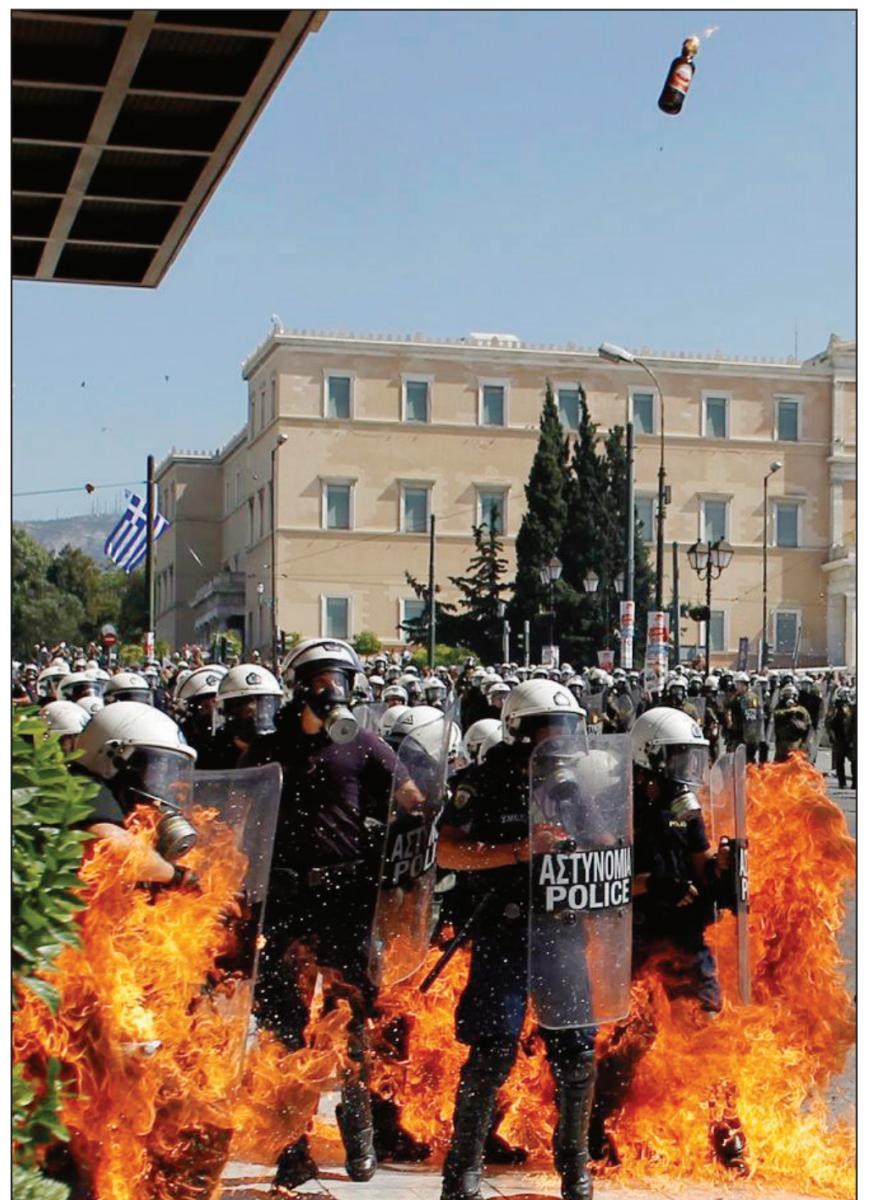

Police fired tear gas at rioters hurling gasoline bombs and chunks of marble during Greece's largest anti-austerity demonstration in six months - part of a 24-hour general strike that was a test for the nearly four-month old coalition government and the new spending cuts it plans to push through.

The brief but intense clashes by a couple of hundred rioters participating in the demonstration of more than 60,000 people came a day after anti-austerity protests rocked the Spanish capital, Madrid.

Hundreds of Spanish anti-austerity protesters gathered again Wednesday, ending near parliament in Madrid amid a heavy presence of riot police. In Tuesday's protest, police arrested 38 people and 64 were injured.

Spain's central bank warned Wednesday the country's economy continues to shrink "significantly," sending Spanish stock index tumbling and its borrowing costs rising.

Across Europe, stock markets fell as well. Germany's DAX dropped two per cent while the CAC-40 in France fell 2.4 per cent and Britain's FTSE 100 slid 1.4 per cent. The euro was also hit, down a further 0.3 per cent at $1.2840.

The turmoil ended weeks of relative calm and optimism among investors that Europe and the 17 countries that use the euro might have turned a corner. Markets have been breathing easier since the European Central Bank said earlier this month it would buy unlimited amounts of government bonds to help countries with their debts.

The move by the ECB helped lower borrowing costs for indebted governments from levels that only two months ago threatened to bankrupt Spain and Italy. Stocks also rose. Media speculation about the timing and cost of a eurozone breakup or a departure by troubled Greece faded.

However, the economic reality in Europe remained dire. Several countries have had to impose harsh new spending cuts, tax rises and economic reforms to meet European deficit targets and, in Greece's case, to continue getting vital aid. The austerity has meant cut wages and axed services.