Age 71 is the last year that you can have a Registered Retirement Savings Plan, so what can you do to make the most of your RRSP before it must be closed?

In order for your RRSP to be closed, you must choose what to do with your RRSP. There are three options. The first is to roll your RRSP into a Registered Retirement Income Fund (RRIF), the second is to transfer your RRSP into an annuity, and the third is to fully de-register your RRSP.

The third option can result in a significant tax liability, and we would never recommend this option (unless the RRSP account balance is insignificant). The first option provides the most flexibility, so is generally our preferred option over option two.

Prior to closing your RRSP, however, there are some strategies to consider. Before we dive into those, let’s first review how RRSP room is calculated and the concept of “earned income.”

A review of “earned income”

Age 71 doesn’t necessarily mean that you will not continue to have “earned income.” There are still a few RRSP planning opportunities if you have ongoing earned income.

The following types of income qualify as earned income:

• Net employment income from salary or wages

• Author’s or inventor’s royalties

• Executor’s and juror’s fees

• Net research grants

• Taxable alimony or maintenance payments

• Net income from a sole proprietorship

• Net income as an active partner in a partnership

• Net rental income from real estate

• CPP/QPP disability benefits

RRSP contribution room is based on your previous year’s earned income and is calculated as 18 per cent of the previous year’s earned income. This creates an unusual situation in the year you turn 71. If you are still working in the year you turn 71, you will have earned income which will generate additional RRSP contribution room next year when you can no longer contribute to your individual RRSP.

Strategy # 1 — Unused contribution room

RRSP room accumulates and never expires. If your contribution room for the year is $18,000, however, you only contribute $5,000, then $13,000 ($18,000 - $5,000) carries forward to future years. In the following year if your additional RRSP contribution room was $18,000, you could then accumulate up to a maximum of $31,000 ($18,000 + $13,000) without being overcontributed.

If you have found yourself accumulating RRSP room over the past few years, your 71st year may be a time to consider maximizing it. That does not mean that you need to use the deductions all in one year — they can be carried forward.

That being said, caution must be exercised with this strategy and it should only be used if you anticipate being able to use the deductions in the future because if they are unused, you will be taxed in the future when the funds are withdrawn from the RRSP without ever benefiting from the deduction claimed on your income tax return.

Strategy #2 — Over-contribution

A strategy you may wish to consider is overcontributing to your RRSP before Dec. 31 of the year you turn 71, up to your estimated RRSP contribution room for the following year.

While you will be over-contributed in your 71st year for one month, you will no longer be over-contributed on Jan. 1 of the following year when your RRSP contribution room becomes available, based on your earned income from the previous year. You may claim the RRSP deduction in the following year or carry it forward indefinitely and claim it against your taxable income when tax efficient to do so.

There is a one per cent per month penalty on RRSP over contributions. The Canada Revenue Agency (CRA) does allow a $2,000 over-contribution without penalty, however.

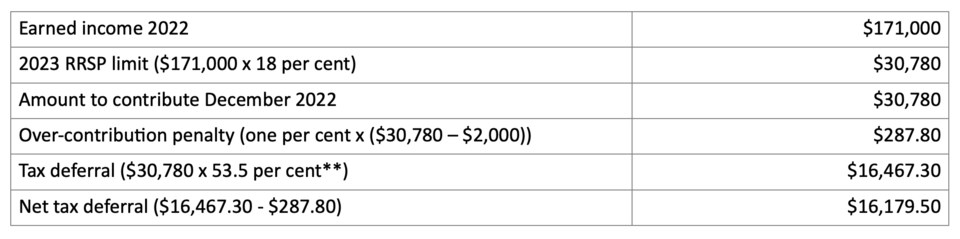

If you have over contributed, you will need to file a T1-OVP – Individual Tax Return for RRSP, PRPP, and SPP Excess Contributions for the year in which you are over-contributed. However, the net tax deferral may more than outweigh the one per cent penalty for one month on the over-contributed amount, as illustrated below:

If you have earned income of $171,000 in 2022 to qualify for the maximum deduction of $30,780 in 2023 ($171,000 x 18 per cent), you may realize a maximum net tax deferral of $16,179.50.

*One per cent penalty on $28,780 over-contribution based on $30,780 less the $2,000 over-contribution grace amount.

**Highest provincial marginal income tax rate in British Columbia.

Don’t forget that you can also use any carry-forward room. These contributions must be made before the end of the calendar year in which you turn 71, as the typical March 1st deadline is not available to those aged 71 in the previous year.

Strategy #3 — Spousal RRSP

If you have made all your available contributions in the year you turn 71 and continue to have earned income (or you did not use your unused RRSP carry forward), you may want to consider contributing to a spousal RRSP if you have a spouse or common-law partner.

If your spouse or common-law partner is younger than 72, you can use your contribution room for deposits into their spousal plan. These can be made up to, and including the year your spouse or common-law partner turns 71.

In addition to providing tax deductions for yourself, this strategy is an effective method of income splitting. The eventual income received from spousal contributions will be taxed in their hands.

To summarize, if you turn 71 or have turned 71 this year, you must choose an RRSP maturity option by December 31 of this year. There are tax saving opportunities if your spouse is under 71, if you have unused RRSP contribution room, or if you have earned income this year.

Consult with your own tax advisor for further discussion and analysis before implementing any tax planning strategies.

Kevin Greenard CPA CA FMA CFP CIM is a Senior Wealth Advisor and Portfolio Manager, Wealth Management, with The Greenard Group at Scotia Wealth Management in Victoria. His column appears every week at timescolonist.com. Call 250-389-2138, email [email protected], or visit greenardgroup.com.