Parents and grandparents who set up a Registered Education Savings Plan (RESP) are referred to as the “subscriber.” The children or grandchildren are referred to as the “beneficiary” of the registered plan. It is the subscriber that we communicate with in respect to both contributions and withdrawals.

When the time arrives that the beneficiaries are pursuing higher education, we meet with the subscriber to ensure they understand fully how to withdraw the funds from the RESP. Specifically, we will review the documentation required, confirm the taxation of the withdrawals, and suggest the best strategy based on the beneficiary’s education and work plans. Below are some of the common talking points that we highlight for our clients.

Proof of enrolment

Before making any withdrawals from an RESP for education, proof of enrolment must be provided, and specific information is required for the proof of enrolment document:

• A letter/document on the educational institution’s letterhead, preferably containing the institution’s name and complete address (including postal code).

• The letter/document should be currently dated.

• The student’s name (and student number, if available) should be in the letter/document.

• Phrasing in the letter/document should state that the student is currently enrolled in that educational institution and the program in which the student is currently enrolled.

• Enrolment status should be full or part time.

If you are unable to obtain an enrolment letter/document as detailed above, an invoice from the educational institution may also be accepted if the above information is on the invoice.

RESP withdrawals are not just for tuition

One misconception is that the proceeds from a RESP can only be used to pay for tuition and textbooks. Withdrawals can be used to pay for all post-secondary education costs. Tuition and textbooks are only part of the cost of education.

Being able to have funds set aside for housing, living costs for school, and transportation is important to add to the calculation. The RESP can even help with expenses related to special needs like note takers or interpreters.

What’s new for 2023

In 2023, the federal government introduced the following changes to the RESP, which are now in effect.

Educational Assistance Payment (EAP) amounts have increased:

• $8,000 maximum (previously $5,000) during the first 13 consecutive weeks of enrolment in a full-time program.

• $4,000 maximum (previously $2,500) for each 13-week period of part-time enrolment.

Divorced or separated parents can now be joint RESP Subscribers for one or more of their children. Previously, only spouses or common-law partners could be joint RESP Subscribers.

Types of withdrawal

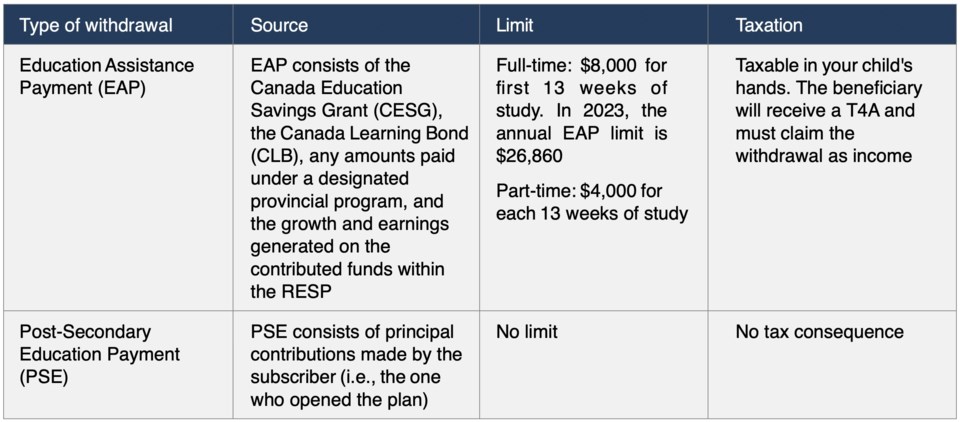

When the beneficiary is enrolled in post-secondary school, there are generally two types of withdrawals. The chart below highlights the two types of withdrawals and their limits and taxation.

Taxation of withdrawals

A key benefit of an RESP is that it allows a portion of the withdrawal to be taxed in your child’s hands. Taxes on EAP withdrawals are paid by the beneficiary, not the contributor. Your child will likely be in a lower tax bracket while in school and will pay little or no tax.

Even if your child has some income from work (e.g., summer jobs, co-op programs), it is recommended to use all of the EAP while your child is attending post-secondary education.

If an RESP continues on after your child leaves school or your child never attends post-secondary education and it has come to a time that you must collapse the RESP (35-year rule), then special onerous rules apply if there is any remaining EAP in the RESP.

The grants and bonds must be returned to the government, and investment earnings (called accumulated income payments or AIP) must be included as the subscriber’s income and taxed at your marginal tax rate plus a penalty of 20 per cent. There is a possibility of transferring the AIP (up to a maximum of $50,000) to your RRSP if you have unused RRSP room.

The Greenard Group RESP withdrawal schedule

When the beneficiaries are ready to begin post-secondary education, we ask the subscribers several questions. Is the beneficiary currently receiving any other income that is taxable? (Scholarships, bursaries, and fellowships are generally not considered taxable income.)

What we are looking to obtain details on are employment income and other sources of income. We like to obtain details of whether this level of income will continue throughout the post-secondary education years or whether it will increase and decrease.

In addition, we like to obtain details about the education program and how many years it is anticipated to last. Specific to family RESP plans, we like to obtain an update from the subscribers on the likelihood that the other beneficiaries will attend a qualifying post-secondary education program. After this discussion, we are able to map out The Greenard Group RESP withdrawal schedule.

Tuition, education and textbook amounts

The federal government eliminated the education and textbook tax credits in 2017. Students are still able to deduct eligible tuition fees paid for the tax year.

A course typically qualifies for a tuition tax credit if it was taken at a post-secondary education institution or for individuals 16 or older who are taking a course to develop skills in an occupation and the institution meets the requirements of the Employment and Social Development Canada (ESDC). The institution should issue a T2202A (Tuition and Enrolment Certificate) at the end of the year, which lists the total paid in the calendar year that is eligible for the student to claim on his or her income tax return.

The student must claim the amount paid even if mom and dad paid the tuition. The student must first try to use the credits on their own tax return. Schedule 11 of the student’s tax return will list the total eligible tuition fees and the total tuition amount claimed by the student.

Kevin Greenard CPA CA FMA CFP CIM is a Senior Wealth Advisor and Portfolio Manager, Wealth Management with The Greenard Group at Scotia Wealth Management in Victoria. His column appears every week at timescolonist.com. Call 250-389-2138, email [email protected], or visit greenardgroup.com.