When you file a Canadian tax return, federal tax is calculated separately from provincial tax — both are calculated on the same tax return.

Every year we look at the indexation factors both federally and provincially — they are not the same. Marginal tax brackets, tax rates, and tax credits are also different federally from each province, which causes a little confusion for the non-accountants trying to absorb it all. For purposes of this article, we will look at the federal indexation adjustments.

At the end of every year, we review the federal indexation adjustments for personal income tax and benefit amounts. Below we have highlighted some of the items that we look at and how we integrate that information into discussions with our clients. The federal indexation adjustments take effect every Jan. 1 relating to income tax brackets, and non-refundable tax credits. Other income-tested benefits like the goods and services tax credit, Canada child benefit and child disability benefits take effect every July 1.

For 2024, the federal indexation amount was 4.8 per cent. In comparison, the federal indexation percentage increases for the previous four years were 6.3 per cent (2023), 2.4 per cent (2022), 1.0 per cent (2021), and 1.9 per cent (2020).

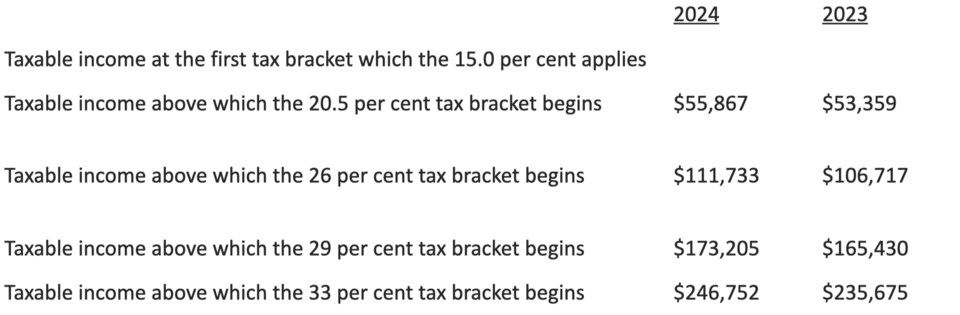

Federal tax bracket thresholds

The lowest tax bracket is 15.0 per cent in both 2024 and 2023. In 2023, the 15.0 per cent rate applied on the first $53,359 of taxable income. Every year, the taxable income is adjusted for each threshold. For 2024, the lowest tax bracket is applied on the first $55,867 of taxable income.

For example, individuals who made $70,000 in 2024 would have the first $55,867 of taxable income taxed at 15.0 per cent and the remaining $14,133 taxed at 20.5 per cent.

Basic personal exemption

In December 2019, the government announced an increase to the basic personal amount. This increase was applicable for individuals whose net income for the year was less than or equal to the amount at which the 29 per cent tax bracket begins.

We have broken this out into two components for 2024: 1) Income at or below $173,205 and 2) Income above $173,205.

Basic personal exemption — net income at $173,205 or below

Individuals whose net income for the year is less than or equal to the amount at which the 29 per cent tax bracket begins ($173,205 for 2024), the basic personal amount increased to $15,705 for 2024. The amount is indexed since 2023.

Basic personal exemption — net income above $173,205

For individuals whose net income is greater than the amount at which the 29 per cent tax bracket begins ($173,205 for 2024), the increase in the basic personal amount gradually phases out so that the basic personal amount for individuals whose income is greater than the top tax bracket threshold ($246,752 for 2024), remains unchanged and continues to be indexed.

For individuals whose net income is above $173,205, the increase to basic exemption is gradually clawed back until it reaches $14,156 for new income of $246,752 for 2024.

Alternative Minimum Tax (AMT) changes

We wrote an article on how AMT tax changes may impact higher income individuals. If your annual income for 2024 is less than the proposed AMT exemption of approximately $173,000 (indexed to inflation annually), then you may not be subject to AMT after 2023.

If your income is higher than $173,000, then AMT may apply in some situations. Below is a partial list:

• If you make large donations annually to registered charities

• If you donate publicly listed securities with large, accrued capital gains to registered charities

• If you sell assets with large, accrued capital gains

• If you sell your business via a sale of shares with large, accrued capital gains

• If you claim the Lifetime Capital Gains Exemption (LCGE) on the sale of shares of a qualifying corporation or qualified farming or fishing property

• If you exercise employee stock options from publicly listed corporations

• If you claim non-capital losses or capital losses from prior years

If the AMT applies, then the standard tax brackets are not applicable, and you should consult with your accountant and advisor for planning purposes for 2024.

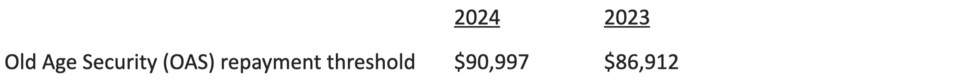

Old Age Security (OAS) repayment

When we are having meetings with clients, we always have the OAS repayment threshold in mind. Clients with large Registered Retirement Income Fund (RRIF) accounts, unrealized capital gains, and retained earnings in private companies often have a few variable choices with respect to the level of income they generate personally every year.

We communicate with our clients’ accountants to map out a level of income that reduces tax throughout our clients’ lifetime and hopefully ensure they also collect Old Age Security. Near the end of every year, we will estimate our clients’ income levels and attempt to get net income (line 23600) up to the repayment threshold.

For couples, we often attempt to have both at this threshold level. The repayment threshold increased $4,085 in 2024 compared to $5,151 in 2023.

Estate planning

For our clients who are 65 and older, we review what their projected net income will be near the end of the year. Depending on the other sources of income, we may recommend triggering taxable capital gains and withdrawing amounts from registered plans (i.e. RRSP or RRIF) to get net income up to the OAS threshold amount.

When factoring in pension splitting and other income splitting steps, we often will look at doubling the OAS repayment threshold amount for couples. For 2024, we would like the combined income for couples to be $181,994 and split evenly at $90,997 each.

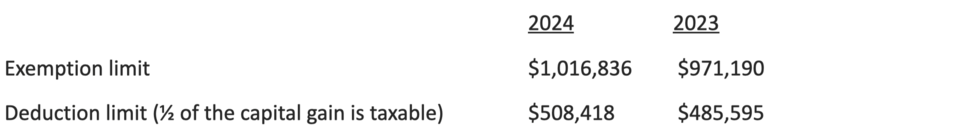

Qualifying small business shares

Many of the medical professionals and business owners that we work with have incorporated their businesses. Incorporation has several benefits; one of which is the ability to sell the qualifying small business shares in some situations and not pay any tax on a portion of the capital gain. When we are preparing financial plans, we will factor in savings. The exemption limit increased $45,646 in 2024 from 2023.

Other indexation

The above indexation amounts are those that commonly impact many of our clients. There are many other non-refundable tax credits that also may be applicable, such as spouse or common-law partner amount, amount for an eligible dependant, Canada caregiver amount for children under age 18, Canada caregiver amount for other infirm dependants aged 18 or older, age amount, Canada employment amount, disability amount, etc.

The indexation adjustments were significant for both 2023 and 2024. We would encourage you to evaluate your current plan and take advantage of the increases when possible. We also recommend that you review your financial plan and make the appropriate adjustments given the higher level of inflation and the adjustments noted above.

Kevin Greenard CPA CA FMA CFP CIM is a Senior Wealth Advisor and Portfolio Manager, Wealth Management with The Greenard Group at Scotia Wealth Management in Victoria. His column appears every week at timescolonist.com. Call 250-389-2138, email [email protected], or visit greenardgroup.com.