This is the time of year when we are planning for the new year. On our list of things to do is mapping out the next years TFSA contributions.

For 2023, the federal department of finance has already announced the TFSA limit will be $6,500 — an increase of $500 from 2022.

The federal department of finance releases index adjustments for personal income tax and benefit amounts every year. The index rate is effectively the Consumer Price Index, reported by Statistics Canada. Most personal income tax and benefit amounts are indexed to inflation annually. For 2023, the index rate is 6.3%.

The TFSA is slightly different in that the annual adjustments are only done to the nearest $500 increment. As a result, several years can go by without changes to the annual limit.

For calculation purposes, the annual TFSA dollar limit was initially fixed at $5,000 and indexed to inflation for each year after 2009. The one exception to this was the one-time large increase in 2015.

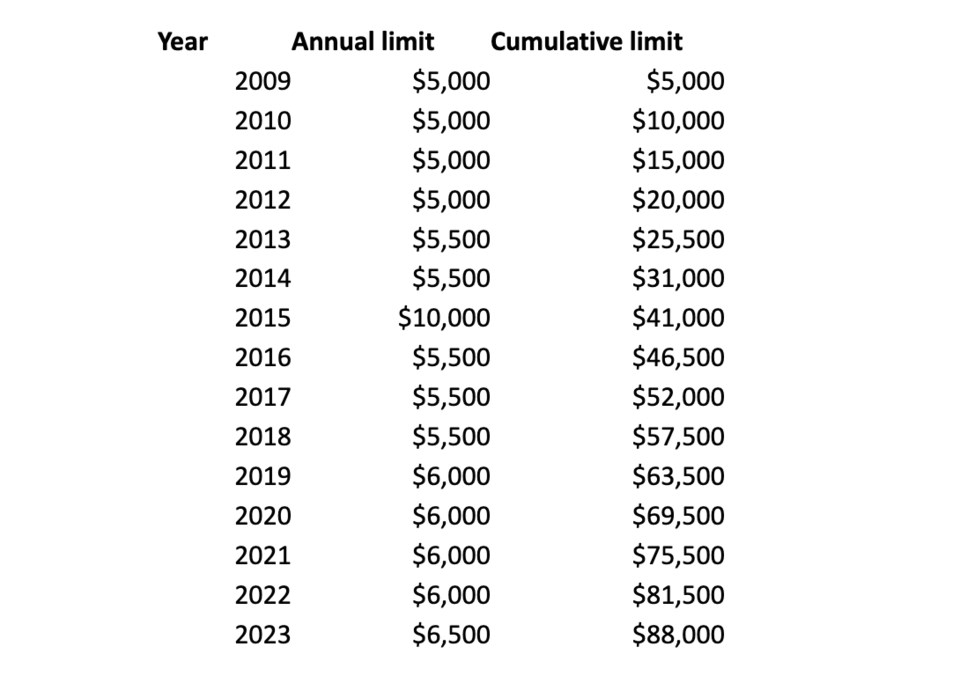

The following are the annual and cumulative limits:

If you have never contributed to a TFSA, the cumulative limit is an important number. If you were 18 or older in 2009, then you may contribute $88,000 to a TFSA beginning in 2023 if you have never contributed to one before.

Contributions

Once you have determined the amount that you are able to contribute to your TFSA, the next step is how to make the contribution. Below are a few options that you may consider when deciding how to contribute to your TFSA.

Cheque or electronic transfer

One of the easiest ways to contribute to your TFSA is by using any excess funds built up in your chequing or savings account. You can use these funds and either write a cheque or transfer the funds electronically to your TFSA account.

Non-registered account

For clients who have a non-registered investment account, cash or securities can be transferred from the non-registered account into your TFSA. Care should be taken prior to executing in-kind transfers to ensure you understand the tax consequences. If a security has a large unrealized gain, the proportionate part of the gain would be realized when the shares are transferred into the TFSA. On the other hand, if you have an unrealized loss, the loss would be denied under the superficial-loss rules if transferred from a non-registered account to a TFSA.

Gifting

TFSAs can be an effective way to split income among family members, such as your spouse or adult children. You may provide a gift to help them make a contribution to their TFSA. Income tax attribution does not apply on TFSA earnings as they are tax-free.

Registered Retirement Income Fund (RRIF)

If you are already at the age where you are withdrawing funds from a RRIF, then it may make sense to do the withdrawal early in the year, versus waiting until the end of the year.

Before the TFSA, if clients did not need the RRIF withdrawal elected amount, it was typically advised to defer the RRIF payment until later in the year. Growth in a TFSA is better than growth in a RRIF. Any growth in a RRIF is fully taxed when the funds are withdrawn, while any growth in a TFSA is not taxed.

If your RRIF payment is greater than $6,500, then consider taking a partial payment early in the year to fund the TFSA.

Our approach of contributing early in the year, and investing 100 per cent in equities, has resulted in TFSA accounts having substantial growth — all tax free!

As TFSA accounts have grown, the need for diversification within the account has grown as well. Historically, we have invested in individual Canadian equities in the TFSAs. When the TFSA was smaller, we avoided foreign equities. The reasoning behind this is that dividend income from a foreign country paid into a TFSA could be subject to foreign withholding tax.

If clients are looking to add a U.S. equity, in order to avoid withholding tax on the dividend income, they should pick an equity that is more focused on growth and does not pay any, or little, dividend income. The growth on the U.S. security is not taxed and can be another investment option to help maximize the tax-free growth.

When deciding what to invest in, we encourage you to know all of your investment options. The choice of investment options should reflect your investment objectives, risk tolerance, and time horizon. Once these have been determined, contributing early is advisable.

Kevin Greenard CPA CA FMA CFP CIM is a Portfolio Manager and Vice President, Wealth Management with The Greenard Group at Scotia Wealth Management in Victoria. His column appears every week at timescolonist.com. Call 250-389-2138, email [email protected] or visit greenardgroup.com/secondopinion.