The MP for Port Moody–Coquitlam is joining the federal NDP party — and every premier in the country — to call for an extension for businesses to repay their pandemic loans.

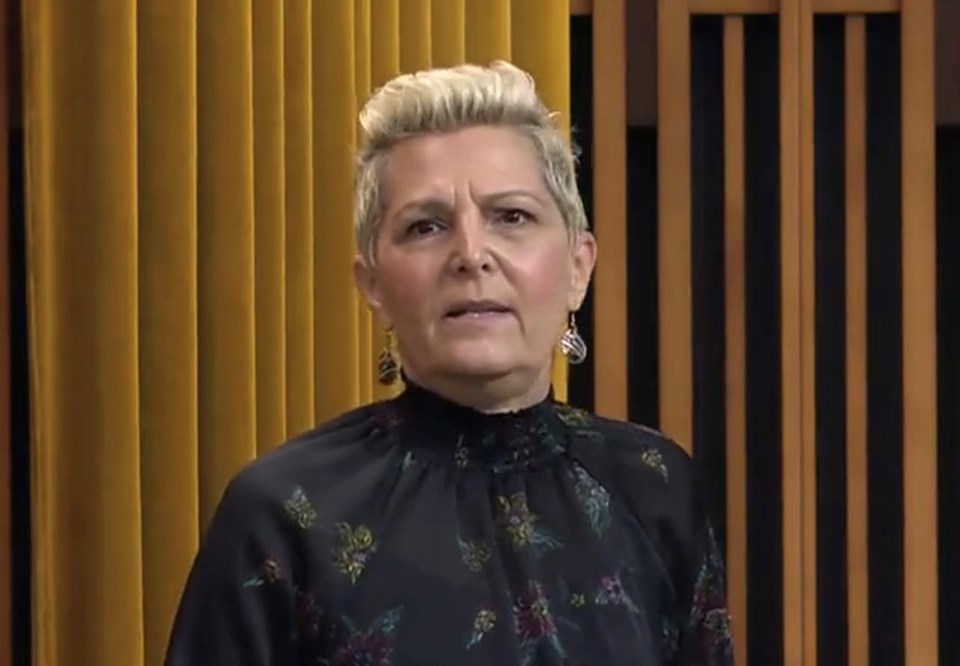

Bonita Zarrillo said most small businesses in B.C. haven’t been able to pay back their Canada Emergency Business Account (CEBA) loans from the federal government that, after Jan. 18, 2024, will no longer be interest-free and a five per cent levy will be added.

During the COVID-19 outbreak in 2020 and '21, nearly 900,000 small businesses in Canada took out a CEBA loan, resulting in $49.2 billion in relief for struggling owners.

In B.C., more than 122,000 small businesses and non-profit groups received CEBA loans totalling $6.6 billion; last year, small businesses generated 34 per cent of B.C.’s GDP.

The Canadian Taxpayers Federation and Canadian Federation of Independent Businesses are also sounding the alarm about the upcoming loan repayments, reporting that 78 per cent of business owners have yet to pay back their loans and many are at risk of missing the deadline.

As a result, thousands of small businesses are at risk of closing next year.

Zarrillo said the repayment deadline and loan forgiveness need to be pushed back.

"Small businesses owners are spending their holidays worrying about how they’ll be able to pay their CEBA loan off after spending the last two years watching the cost of their rent, supplies and products skyrocket," Zarrillo said in a news release issued Dec. 19.

Meanwhile, the Tri-Cities Chamber of Commerce has been advocating for its 1,300 local members, saying now is not the right time to recall loans for small business owners.

In a statement this fall, CEO Leslie Courchesne said that "small business owners need to survive and recover from the effects of the pandemic, the extraordinary rising costs of doing business, supply chain disruptions and other challenges."

"Calling in these loans too early puts many small businesses at risk of having to close their doors," she said.

Responded Liberal MP Ron McKinnon (Coquitlam–Port Coquitlam), "The bottom line is that, if you are a small business and do not currently have the funds to repay your CEBA loan, you now have three years to repay it in full. The CEBA program, which delivered over $49 billion to nearly 900,000 small businesses and non-profits across the country, including in Coquitlam and Port Coquitlam, was an essential part of the federal government’s swift response to the COVID-19 pandemic. The additional flexibility that we announced is significant support for small businesses who might still be struggling to make ends meet."