Greater Victoria is the country’s third least affordable real estate market, after Vancouver and Toronto, according to Royal Bank of Canada’s latest housing affordability study.

The capital region’s homes are close to record-level unaffordability when compared with local incomes, as prices have not fallen along with sales, and interest rates have risen, reported the bank.

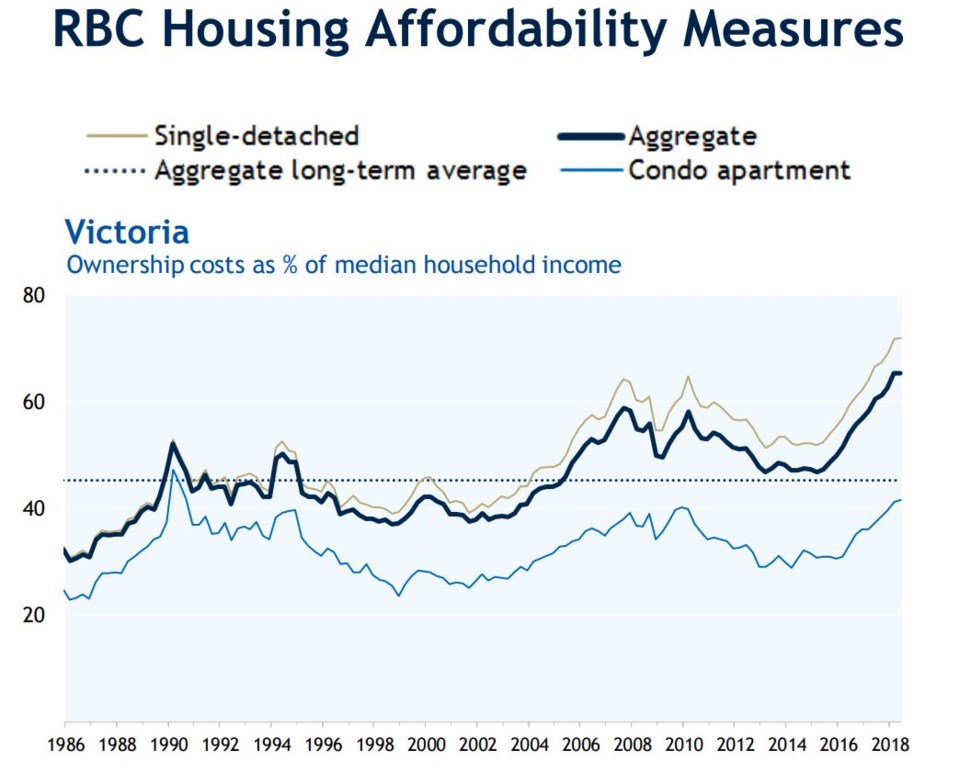

RBC’s affordability index for Greater Victoria in 2018’s third quarter was 65.3 per cent, which is only 0.1 percentage points lower than the previous quarter, and still very close to that record high.

That index means that a person with an average local income would have to spend 65.3 per cent of that income on housing costs to buy an average priced home (aggregate of property types, assuming a 20 per cent down payment).

Single-detached homes were even higher than that, at more than 70 per cent, while even the average condo was unaffordable at around 40 per cent of local earnings.

In order to pass the mortgage stress test and service a mortgage on an aggregate-priced home in Greater Victoria at an affordable level, the annual household income required was $154,000 in the third quarter.

RBC said in its report, “RBC’s aggregate affordability measure stalled in the third quarter (down marginally by 0.1 percentage points) but the fact remains that ownership costs in Victoria are the third-highest in Canada. So local buyers continue to struggle to find something they can afford … Add in the mortgage stress and market-cooling measures introduced by the B.C. government and it’s not a surprise that home resales fell 20 per cent this year.”

The bank added that it expected affordability levels to stay approximately where they are over the next year, as any decline that may occur in prices would be largely cancelled out by further interest rate increases.

The report said, “We expect the Bank of Canada to hike the overnight rate two more times next year, which will sustain upward pressure on ownership costs. Still, we don’t think that affordability is set to erode significantly either. A generally soft environment for prices and rising household income will contain some of that pressure.”

Nationwide, the affordability index increased to its worst level in Canada since 1990, when interest rates were extremely high. A key reason for the near-record levels is that while Vancouver, Toronto and Victoria’s indexes have barely improved, affordability in other major cities – especially Montreal – is deteriorating.

RBC said of the national index, “It would have taken 53.9 per cent of a typical household’s income to carry the ownership costs of average home bought last quarter. This is up 1.5 percentage points from a year ago.”

RBC’s affordability index compares local average incomes with local average home prices, but it does not take into account any private wealth, non-local incomes, home equity built up among those who own a home, or generational wealth transfer to young buyers.