Vancouver is positioned well to add housing supply to its market by converting office space into residential buildings, according to data gathered by Avison Young (Canada) Inc.

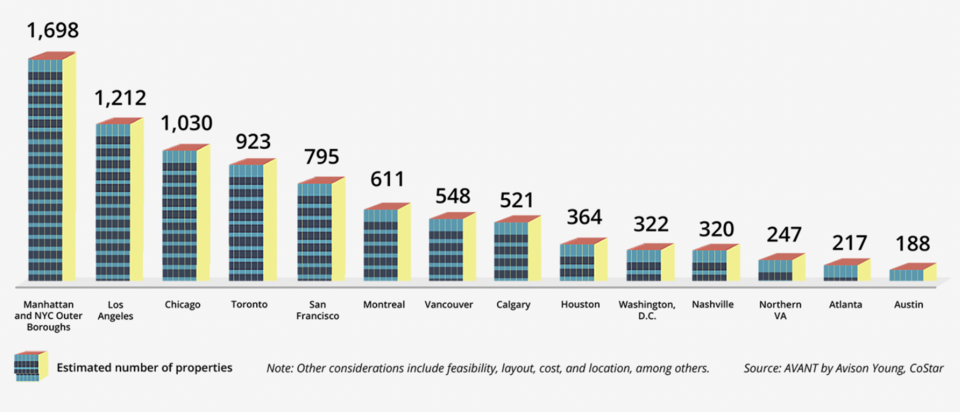

The global commercial real estate firm estimates 548 office buildings in Vancouver could fit the parameters for what the industry refers to as “adaptive reuse.”

As the city looks to increase housing stock, experts say office conversions offer a creative solution that will not only work to solve the housing crisis but add vibrancy to areas that are seeing increases in Class B and C offices.

“Groups are leaving certain types of asset classes and moving to AAA class. At the same time, we're hearing a lot about housing supply shortages,” said Scott Pickles, principal and senior vice-president, Canada consulting leader, with Avison Young.

“There's an opportunity to convert to solve the problem. There's going to be someone who's interested in seeing if it'll work and that's what I think is very exciting.”

Downtown Vancouver’s Yaletown neighbourhood has more pronounced availability for Class C spaces. Class A vacancy currently sits at 5.8 per cent compared with Class C vacancy at 28.6 per cent, according to Avison Young’s Metro Vancouver 2023 Office report.

Across North America, 34 per cent of office buildings in 14 major markets could be potential candidates for office conversions, according to Avison Young.

To meet this standard for adaptive reuse, a building must have been built before 1990 and have floor plates below 15,000 square feet, according to Sheila Botting, a principal and president of professional services, Americas, at Avison Young.

Many Vancouver office buildings have smaller floorplates, roughly 10,000-12,000 square feet. Cities such as Calgary tend to build with larger floor plates, roughly 20,000-40,000 square feet, which eliminates potential conversion supply.

“Now we've got some of the bigger new buildings going into Vancouver. That makes it more viable from a conversion perspective, the technical part,” Botting said.

From there, companies will determine if a conversion aligns with their strategic and long-term goals, if the building is in a viable location, if it meets the technical requirements and if a conversion is financially feasible, according to Pickles.

There has been a push in Alberta to convert office and commercial buildings into rental units.

These conversions can offer cost-effective and sustainable rent solutions, according to Natalie Marchut, the City of Calgary’s manager of development and strategy for the downtown strategy business unit.

Calgary offered financial incentives in 2021 to convert office spaces through the Calgary Development Centre Program, she said at the Western Canada Apartment Investment Conference in April.

“Calgary's problem started back in 2014, 2015, when the oil recession started, and the pandemic has just compounded the problem. So we're ahead of the game, for better or for worse, because we've been dealing with this for almost the last nine years now,” she said.

Calgary’s downtown office vacancy rate of 27.1 per cent further encourages these conversions, said Botting. Vancouver, on the other hand, has a downtown office vacancy of 10.8 per cent, with Class B offices having the highest vacancy rate.

“Calgary has got a much higher office vacancy rate, but from a market perspective, the owners are being more rigorous as they look at what to do with some of these assets,” Botting said.