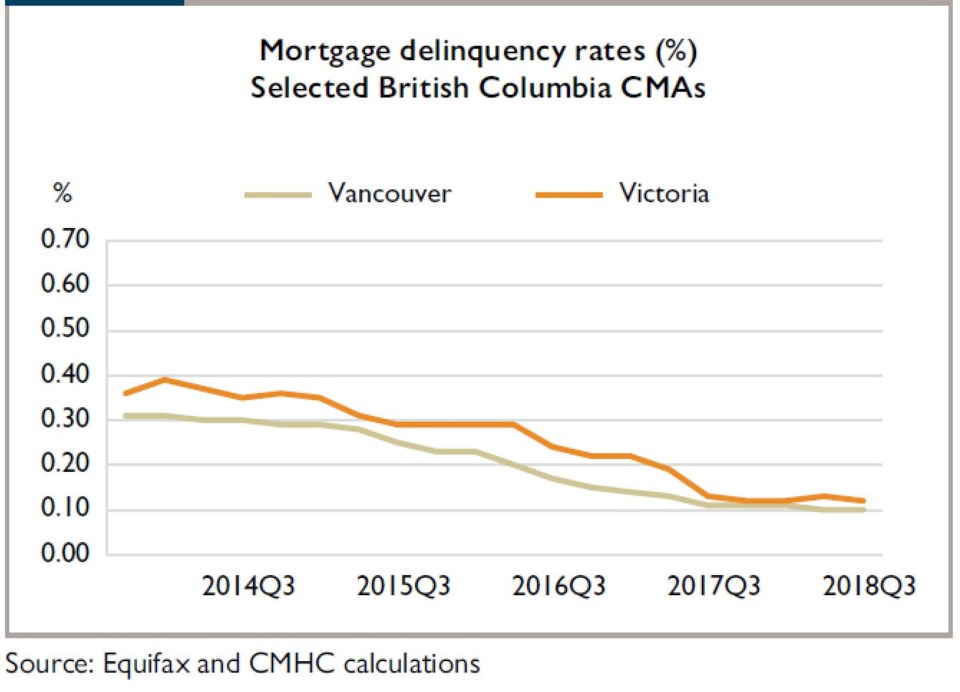

The proportion of Greater Victoria homeowners who are three months or more behind on their mortgage payments is falling, and has been dropping for years, according to Canada Housing and Mortgage Corporation data released February 27.

Only 0.12 per cent of mortgages in the Victoria Census Metropolitan Area were delinquent in 2018’s third quarter, down slightly from 0.13 per cent in the same quarter of 2017, said the federal housing agency. This figure is also below the provincial average of 0.16 per cent mortgages in delinquency.

Despite the surge in home prices over 2015-2017, mortgage delinquencies in the region have been in steady decline since 2014. However, although the Q3 2018 figures show another drop, the rate of decline has largely flattened over the year between Q3 2017 and Q3 2018.

CMHC said in its report, “A pullback in MLS sales combined with slowing job growth and rising interest rates up to Q3 2018 has contributed to slower growth in credit, resulting in the flattening of the delinquency rate trend."

The average Equifax credit rating in Victoria CMA increased by one point, on a year-over-year basis, to 780 points. This figures has been steadily increasing since 2014.