Most of Greater Victoria’s 13 municipalities saw the typical assessed value of single-family homes either drop or stay the same as last year, according to information released Thursday by B.C. Assessment.

The 2020 property assessment roll details the assessed values of about 374,600 properties on the Island and more than two million provincewide.

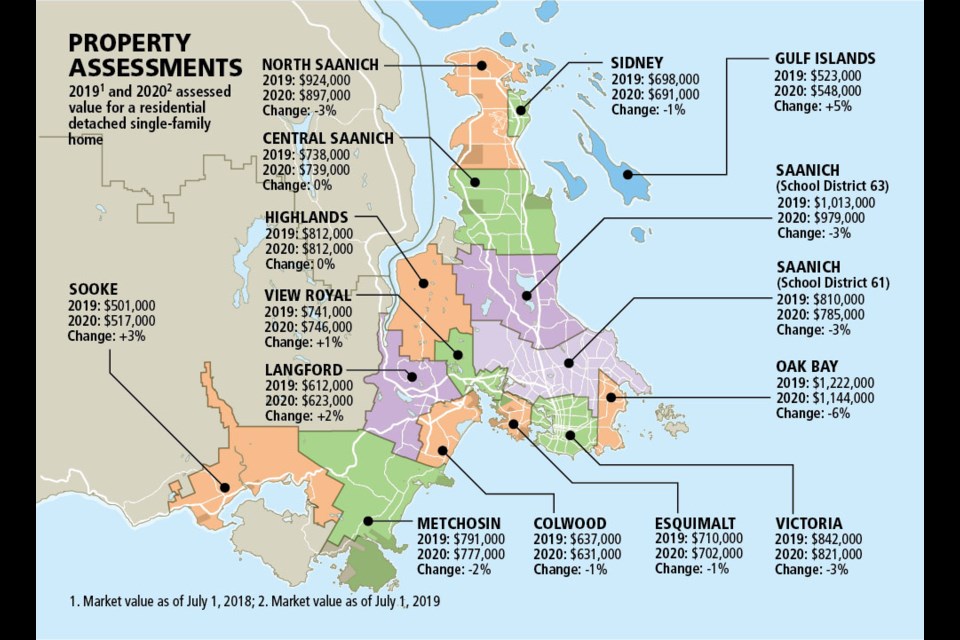

It shows the residential property values for a typical single-family home dropped by as much as six per cent in Oak Bay, while homes in Highlands and Central Saanich saw no change.

Only Langford, Sooke and View Royal saw increases in the typical assessment. All other municipalities saw values drop.

That should come as no surprise to property owners after B.C. Assessment warned last month values could drop by as much as 10 per cent in some areas of Greater Victoria due to a softening of the real estate market.

The Crown agency said some single-family homeowners could see increases of as much as five per cent.

“The market has stabilized in most areas of Vancouver Island this year. In the south part of Vancouver Island the majority of residential property values are moving [between minus five per cent and plus five per cent], while up Island the value increases are a little higher,” said assessor Tina Ireland. “The commercial and industrial markets are generally showing increases over last year.”

The relatively slight changes in market conditions reflected by this year’s assessment is unlikely to move the needle in either the real estate market or the home-building sector.

Casey Edge, executive director of the Victoria Residential Builder’s Association, said the effect on builders will be negligible as their concerns over the cost of land and being able to sell finished homes remain unchanged.

“The reality is this is a very risky market to get into,” Edge said. “The price of land is still very high and the costs of labour and materials have gone up and many municipalities have been raising fees and making it more challenging to build in their communities.”

Edge said the only thing this year’s assessment roll indicates is provincial government taxation measures to improve housing affordability have not worked.

In Greater Victoria, the greatest increase in assessed value was three per cent in Sooke, where the typical home was valued at $517,000 as of July 1, 2019. Oak Bay saw the greatest decrease, six per cent, to $1.14 million.

Edge said the fact property assessments increased in the more affordable communities of Langford, Sooke and View Royal, while the biggest decrease was in Oak Bay, is proof the taxes intended to make housing more affordable are having the opposite effect.

But Minister of Municipal Affairs and Housing Selina Robinson said the government’s speculation tax has made a positive difference. “As the 2020 property assessments are released, people living in the regions hardest hit by sky-high property-value increases are seeing a moderating trend in housing prices,” she said in a statement. “For the second year in a row, we see only modest changes in the value of both single-family and strata homes in most regions, particularly in the Lower Mainland and on Vancouver Island.”

Modest changes do not necessarily make things affordable.

Real estate experts suggest the federally imposed mortgage stress test has had more impact on cooling off the housing market than provincial measures such as the speculation tax.

They also point out those kinds of measures have resulted in higher prices for homes at the lower end of the market.

David Langlois, incoming president of the Victoria Real Estate Board, said the biggest impact on real estate activity came from the lending rules, which affected both new buyers coming into the market and those looking to upgrade.

“People’s buying power got reduced substantially in some cases,” he said, noting buyers who may have been considering the $1-million range were being forced to look at homes below $800,000. “It compressed activity into a particular price point.”

That meant there were several categories of buyers looking at a limited supply of houses, creating a seller’s market and higher prices at the lower end of the spectrum.

The assessment roll appears to back that up. It shows on average that single-family homes in Greater Victoria saw little change or a slight drop in this year’s assessment, while the condo market saw its values rise.

According to B.C. Assessment, the typical assessed value of a strata home on the Island was up in most municipalities in Greater Victoria — from two per cent in Saanich, Oak Bay and Esquimalt to four per cent in Langford and Colwood.

Condo owners in Nanaimo were likely to see value increase by two per cent, while a typical assessment for strata units in Courtenay increased eight per cent, and 10 per cent in Campbell River.

The west coast of the Island had the largest increase, with Tofino seeing a 15 per cent increase in the assessment of a typical single-family home to $883,500 and Ucluelet seeing an 11 per cent increase to $445,000.

The most highly assessed property in the region was once again James Island, at $56.47 million as of July 1, 2019. In the previous assessment, the island was valued at $56.76 million.

The most valuable single-family home is once again 3160 Humber Rd. in Oak Bay, assessed at $15.2 million, versus $16.16 million a year earlier.

The most valuable commercial property on the Island is Mayfair shopping centre which is valued at $306 million, while Hillside Centre ranks second at $270 million.

Catalyst’s Crofton paper mill, assessed at $133 million, is the most valuable industrial property on the Island followed by Victoria International Airport at $131 million.

Assessment notices will start to appear in mailboxes this week, and are available online now at bcassessment.ca.

The assessment is an estimate of a property’s market value as of July 1, 2019 and physical condition as of Oct. 31, 2019.

B.C. Assessment said changes in property value reflect movement in the market and can vary greatly from property to property.

Assessors take into account current sales in an area as well as the size, age, quality, condition, view and location of a property.

The Island roll increased in value to $255 billion from $246.9 billion in 2019. About $4.14 billion of the Island’s assessments reflect new construction, subdivisions and rezoning of properties.

The total value of real estate in B.C. — there were 2,091,135 properties on this year’s roll — is over $1.94 trillion, a decrease of 2.5 per cent from last year.

B.C. Assessment said 98 per cent of property owners accept their assessment without an independent review.

Ireland said the rate of assessment appeals has remained steady at below two per cent over the past 10 to 15 years, regardless of market activity.

“Property owners can find a lot of valuable information on our website, including answers to many assessment-related questions, but those who feel that their property assessment does not reflect market value as of July 1, 2019, or see incorrect information on their notice, should contact B.C. Assessment as indicated on their notice as soon as possible in January,” Ireland said.

Property owners may submit a notice of complaint by Jan. 31 to ask for an independent review by a property assessment review panel. The panels, appointed annually by the ministry of municipal affairs and housing, typically meet between Feb. 1 and March 15 to hear complaints.

Increases in assessments do not necessarily mean an increase in property taxes, Ireland said. “How your assessment changes relative to the average change in your community is what may affect your property taxes,” she said.

B.C. Assessment can be reached at 1-866-825-8322. Information is also available online at bcassessment.ca.