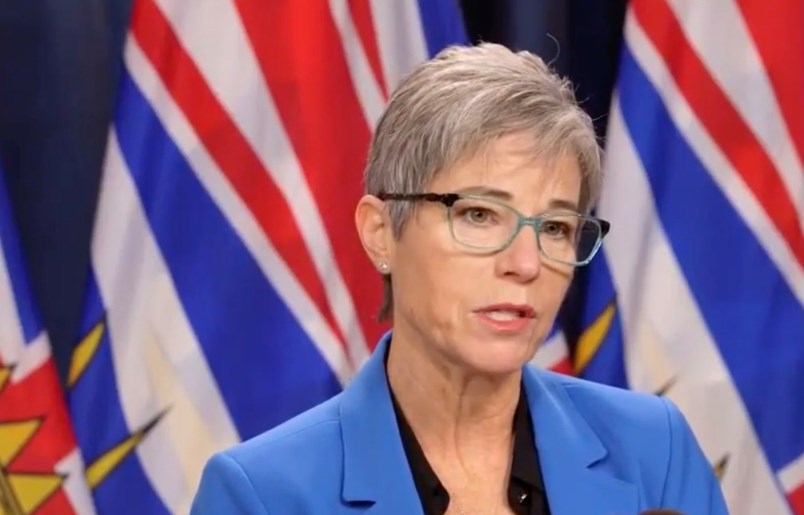

It’s probably just as well for Finance Minister Selina Robinson that she doesn’t have the faintest idea of the costs of the storm damage yet. Any serious reckoning would have muddied the rosy snapshot of the provincial finances she released Monday.

The quarterly report covering the summer goes up to Oct. 1 and the bottom line continues the trend of delivering good news updates on worst-case budget forecasts that don’t materialize.

That started in the first year of the pandemic and it’s carrying on. The government’s initial estimate in the grips of the first wave of COVID-19 was that it could create a $13.6 billion deficit. It turned out to be $8 billion.

The initial estimate of the deficit for the second year — the current fiscal year — was $9.7 billion. That was adjusted to $4.8 billion in the summer and on Monday it was whittled down to $1.7 billion.

The excuse for being off by that margin was that it’s in line with changes reported by other provinces. Stronger economic data released by StatsCanada illuminates the pandemic impacts over 18 months, the government said.

But the suspicion is that some political games are being played with these estimates once they leave the hands of the experts in the Finance Ministry. It looks like the games will come to an end following the storm that ravaged B.C.

Some of the leeway that’s created by underestimating revenue that shows up later is going to be eaten up by the major emergency road-building and flood repair efforts that will run through the rest of the fiscal year and beyond.

There’s a billion-dollar forecast allowance on the books to manage unexpected costs. There’s another $3.25 billion in contingency funding for COVID-19 costs, some of which might be available for redirection. It won’t be clear until February at the earliest if those funds would cover the storm costs.

Rebuilding highways at double-quick time, in the winter, during labour shortages, is an expensive proposition. The other flood losses and agricultural losses are a different category, but there’s nothing to suggest they won’t be expensive.

So the $1.7 billion estimate may be the end of the line when it comes to delivering better-than-expected fiscal news.

The briefing noted significant uncertainty involving the storm damage, not to mention the pandemic. Higher inflation and strained supply chains also work against the deficit estimate going lower.

Asked directly several times about the looming price tag, Robinson said she didn’t have a number and didn’t know when an initial estimate will be produced.

Whatever it is, she said the government, with as much help from Ottawa as possible, will have to pay it.

“We’re going to continue to invest what we need to invest to be there for people,” she said. “We’re going to make sure we can come back from this and build back better.”

So as of Oct. 1, the picture was one of “further improvements” to the fiscal forecast. The real expenses are reasonably close to what was projected. It’s the revenue estimates that are off. The province now stands to bring in $9.3 billion more than originally forecast.

Across more than a dozen government revenue streams, the latest updates are higher in most of them. But it turns out there really is such a thing as an embarrassment of riches. Some of them are in politically uncomfortable areas.

Fuel and carbon tax revenue will be up almost half this year. It’s attributed to higher volume sales. But the climate change plan is to reduce fuel use, not increase it.

The bigger issue for the NDP is the property transfer tax. They spent years harping on the B.C. Liberals for relying on runaway real estate prices to run a government. But they’re doing the same thing.

After a slight moderation, the property transfer tax is continuing to bring in big dollars. Affordability was their slogan, but it’s still an issue.

Elsewhere, the update shows $1.2 billion in pandemic spending for the first half of the fiscal year, April-September. About half is health measures. Another $440 million is for assistance programs for employers and employees and $190 million went to paid sick leave, housing, child care and school safety measures.

The 2021-2022 budget outlined $1.8 billion for pandemic response over the year, so a dip into the contingency fund looks possible.

lleyne@timescolonist.com