A local tech company is offering no-interest loans to help Victoria small businesses outlast the COVID-19 pandemic.

Co-founder Andrew Wilkinson announced Tuesday that Tiny will offer such businesses zero per cent unsecured loans. The idea is to offer small amounts — typically $500 to $2,500 — to as many recipients as possible.

“Many otherwise healthy businesses have hit desperate cash crunches, and we hope to help them make it through this period of uncertainty,” he posted on social media. “We can’t help everyone, but we will be doing everything we can. … Under the terms of our loans, we can’t make any money and we can’t enforce repayment.”

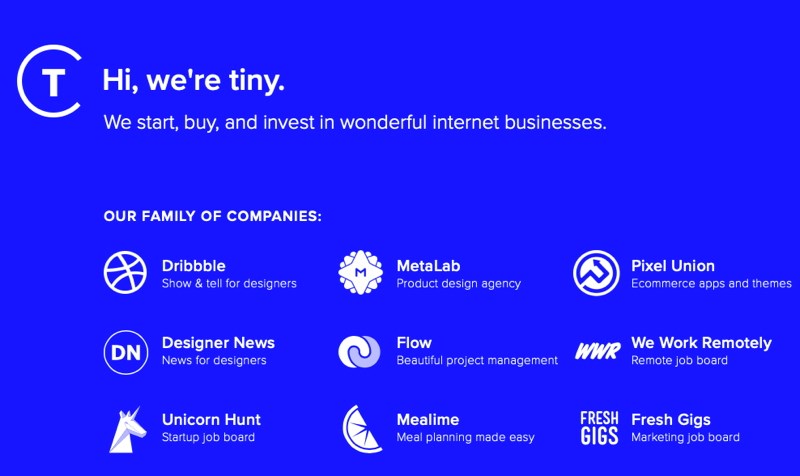

Tiny is a Victoria-based tech company that owns a family of 20 internet-based businesses, including Dribbble, MetaLab and PixelUnion. It has an interest in another 80.

Wilkinson, who moved to Victoria as a teen, was just 19 when he launched MetaLab. Now 34, he co-founded Tiny in 2015.

He said he expects the small-business loans to total $50,000 to $150,000 over the next couple of months. By late afternoon Tuesday, about 30 companies had asked about the program. You can learn more about it here.

Wilkinson said Tiny launched the initiative because the pandemic is hitting so many small businesses so hard.

“We’re a big company and it’s hard for us.”

Tiny also announced that it would be taking part in a separate effort to aid the Victoria Rapid Relief Fund.

Catherine Holt, CEO of the Greater Victoria Chamber of Commerce, said she admires what Wilkinson is doing, but what’s really needed is drastic action from the province and Ottawa.

“They’re the only ones who have the kind of resources to save small business in this town.”

Governments have deferred various taxes and have offered small businesses a wage subsidy equal to up to 10 per cent of the wages paid over the next three months, but with so many now being forced to close or restrict operations in the name of social distancing, those measures are no longer enough, Holt said.

If the government wants to keep businesses open, and not merely encourage them to lay off workers so that they can collect employment insurance, it needs to offer much heavier wage subsidies, she said. “Keep people working.”

Also, taxes must be cut, not just deferred, she said. “If government wants businesses to be there when this thing passes, it’s got to help with those things right now.”

As it is, Victoria businesses are looking at the potential loss of the entire tourist season.

“We’re in enormously catastrophic circumstances,” Holt said. “We need a huge redesign of what government is doing for business right now.”