For the second time this month, ICBC has lost big in B.C. Supreme Court.

After a two-week trial and three-day deliberation, a jury on Monday night awarded a single mother $216,500 for pain and suffering, lost wages and medical expenses for an accident the insurance giant argued never happened.

The 26-year-old Abbotsford woman couldn’t believe she was put through the ordeal.

“ICBC denied my claim from the beginning and I was just relieved when the jury came back and saw through ICBC and what they were trying to do,” Dainya Watson said.

The firm, however, stressed that it did not accuse Watson of fraud.

“In this situation, we had a statutory obligation to defend our customer (the motorist blamed for the accident) from the action taken against her,” company spokesman Adam Grossman said in a statement.

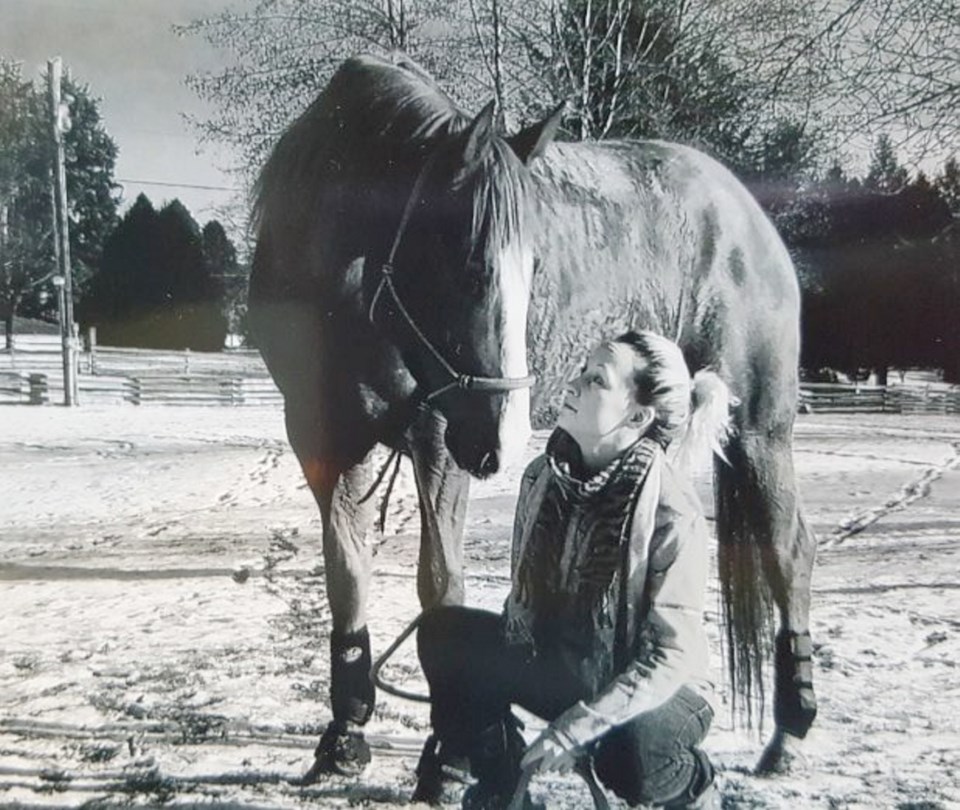

Watson was injured horseback riding Jan. 11, 2013, after her horse was struck by a driver who fled the scene.

“I was on the gravel and a van veered off the road and side-swiped us,” she explained. “It knocked us over; my horse rolled over top of me.”

The van slowed but when the driver saw the horse and Watson get up, the motorist took off.

Watson gave chase, and thought she had found the vehicle at the driver’s home. She called police, ICBC, and then went to hospital.

Doctors suspected she had a broken pelvis but they couldn’t take an X-ray because they also discovered Watson was pregnant.

“That was a surprise, for sure,” she quipped.

“I was on bed rest for eight weeks ... I couldn’t take pain medication through the pregnancy because of the baby ... then I had to have a C-section early.”

Jurors didn’t think the van Watson fingered was the right one, but they said a vehicle was involved and so the insurance company had to pay.

Watson said in its defending the driver ICBC made her feel like she was in the wrong.

“ICBC could have simply acknowledged that our client was not lying ... and settled this claim under the hit and run provisions a long time ago,” her lawyer Eric Goodman fumed.

He drew comparisons with another case completed only a fortnight ago in which Justice Susan Griffin awarded $350,000 in punitive damages against the Crown corporation for baselessly accusing a recent immigrant of lying about her injuries.

In a current advertising campaign, ICBC says 20 per cent of claims are fraudulent — a staggering number suggesting one in five is a scam artist who is faking, malingering, exaggerating or just plain lying.

“It seems that ICBC is increasingly electing to defend injury claims with the use of a jury rather than a judge alone, which is a very clever tactic indeed given ICBC’s marketing blitz suggesting that British Columbians should not be trusting one another,” Goodman complained.

“As a result, groundless seeds of doubt have been planted before the trial even begins.”

He added that he was troubled that ICBC does not cite any research to support the inflammatory statistic but “spending hundreds of thousands of advertising dollars to perpetuate a myth of pervasive fraud, it serves to taint the jury pool of the general public.”

ICBC spokesman Grossman disagreed, noting that of 60,000 to 70,000 claims a year only about 0.5 per cent go to trial.

Watson continues to struggle with back pain from her injuries.

The baby, her daughter Brookylnn, now is two-and-a-half and fine. Watson also has an eight-year-old son, Kayden. Watson’s horse, Tornado, who will be seven in July, now can be ridden for pleasure but no longer can compete.

In the previous case, the woman sued ICBC after being falsely accused over her claim of being hit by a car Jan. 31, 2000 while crossing Nelson Avenue at Imperial Street in Burnaby.

“The malicious prosecution brought fear and shame to a vulnerable person,” Justice Griffin said. “The criminal charge against (Danica) Arsenovski was only stayed on the day of the criminal trial. The stain she feels on her character as a result of being charged criminally might never be erased.”

The company is appealing that decision.