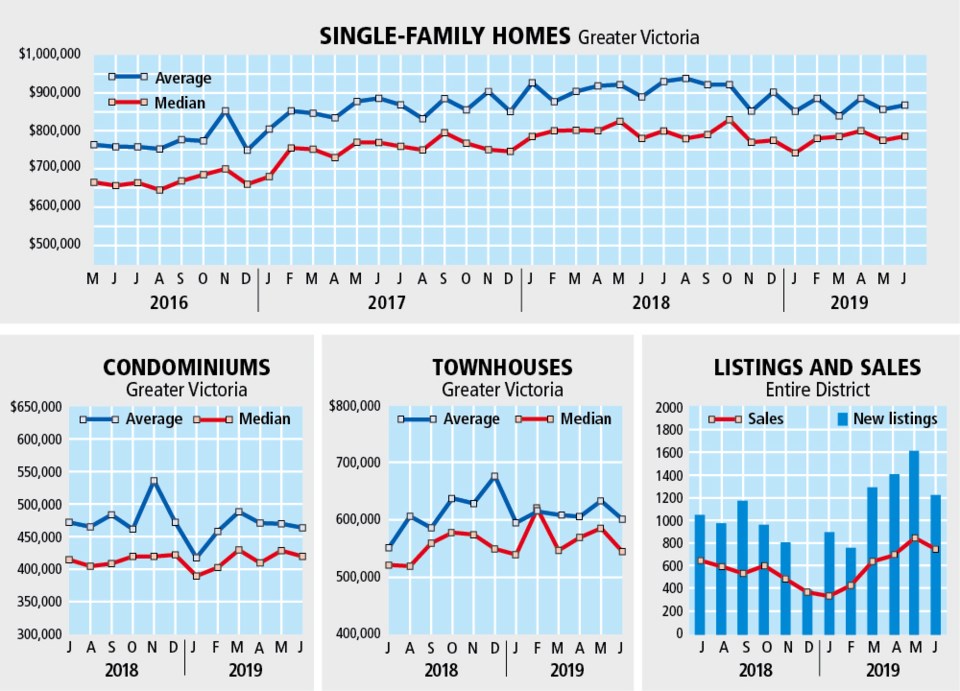

Greater Victoria real estate sales in June climbed to 740, up 4.5 per cent from the same month last year. That marks the second month in a row that year-over-year sales increased through the Victoria Real Estate Board. Those higher sales figures broke a stretch starting in late 2017 when sales lagged behind those of the same month a year earlier.

The 848 property sales in May marked an increase of 12.3 per cent from May 2018.

June “tends to signal the end of the active spring market,” and has trended lower than May for the past few years, board president Cheryl Woolley said Tuesday.

July and August are typically less active than the spring, she said.

So far this year, there have been 100 fewer listings than last year, which makes it harder for buyers hoping for more options, Woolley said. A total of 3,040 properties were listed through the board as of the end of June.

The benchmark price — the price of a typical house in a specific area — for a single-family house in the core was $859,600, down from $898,500 in June 2018. The core is made up of Oak Bay, Esquimalt, Victoria, Saanich and View Royal.

A condominium in the core had a benchmark of $524,100 last month, up from $509,000 a year earlier.

Woolley speculates that some buyers might be waiting for the new federal first-time buyer initiative coming into effect on Labour Day. The $1.25-billion plan will see the government take an equity stake in homes to ease mortgage costs for qualified buyers. It’s designed to help in purchases with a maximum price of $565,000. Previous homeowners can qualify under certain conditions, and it might permit the purchase of a building with up to four units.

Under the program, federal funds will cover up to five per cent of a mortgage on existing homes for households earning less than $120,000 a year, on a mortgage of no more than $480,000. The value increases to up to 10 per cent for new homes to encourage construction and expand supply.

Woolley said it’s hard to estimate how many Greater Victoria buyers will take advantage of the incentive, but because of the low threshold for maximum purchase price, the program might only help those buying condos.

“This could mean a slight uplift in [sales of] lower-priced properties in the fall, if more buyers are enabled to enter the market.”