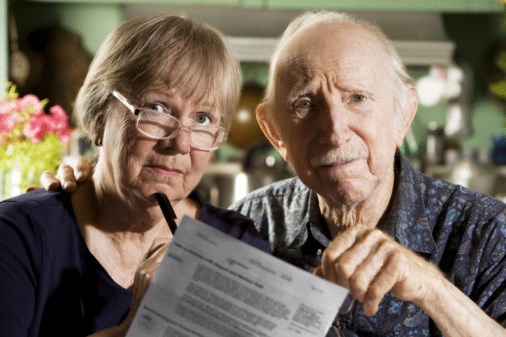

British Columbians over 65 years old have an average of $51,636 in household debt – almost 9% higher than the average debt held by seniors nationwide of $47,549, according to a recent TD Economics report.

Canada-wide, the amount of debt held by seniors increased by about 15% from 2011 to 2012, with an average jump of $6,000.

David Smith, president of Personal Bankruptcy Canada, said the reality is that many Canadians enter retirement unprepared, which could have dire consequences.

“Living on a fixed income can pose many challenges for new retirees but with more seniors entering retirement with debt and not enough savings, any sort of unexpected financial hiccup can push them into a bankruptcy,” said Smith.

“It’s amazing how many retirees I see using credit cards to pay their bills.”

The provinces with the highest levels of debt among seniors are:

· Alberta ($69,586); and

· Ontario ($58,969).

Seniors in Manitoba and Saskatchewan have the lowest levels of personal debt, with an average of $32,248.