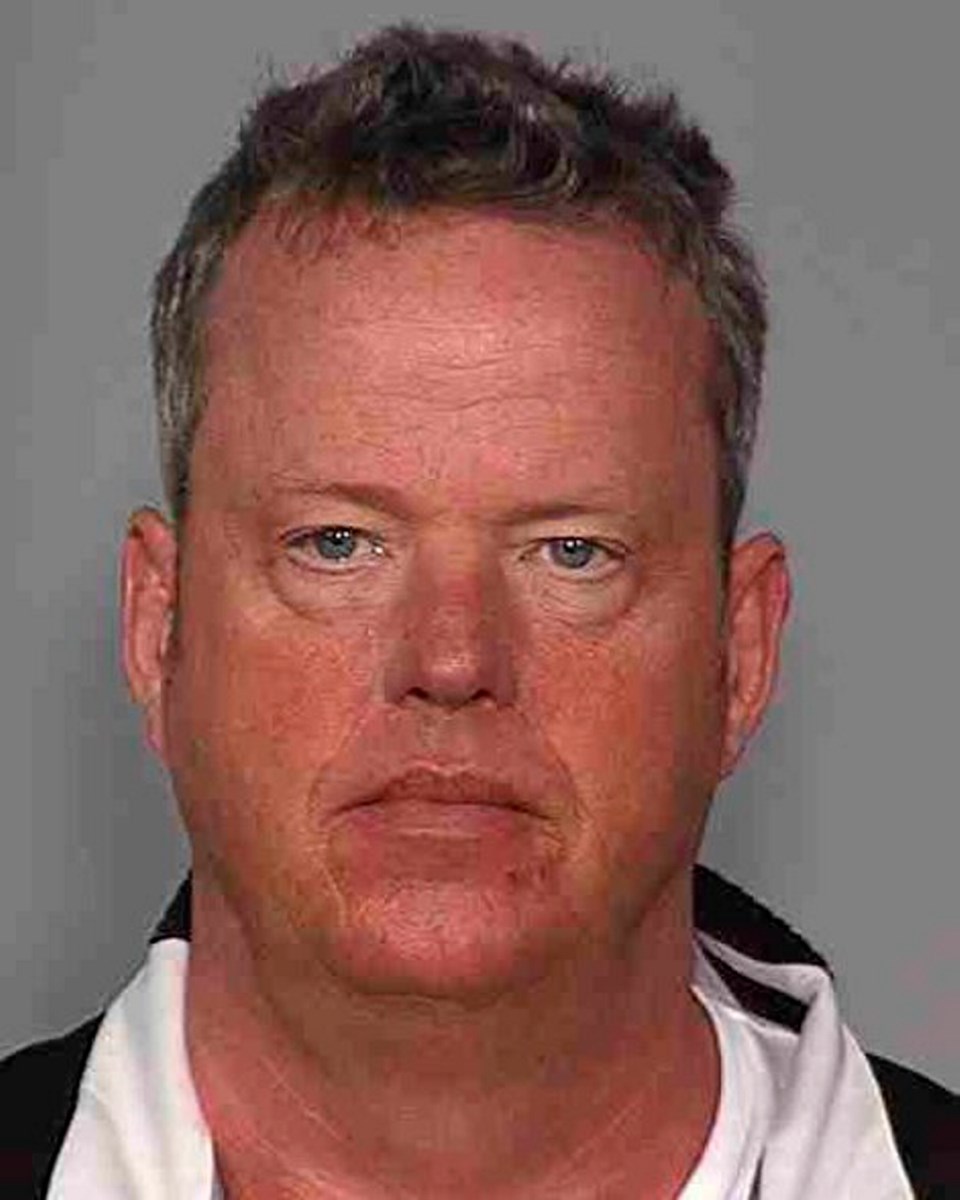

Conflicting evidence has delayed the B.C. Securities Commission from being able to renew its claim for an administrative penalty against disgraced former investment adviser Ian Thow.

Justice James Williams ruled this week that because evidence from Thow and the BCSC was at odds, the court could not decide the matter at a summary trial proceeding. The evidence in question is Thow’s assertion that he was told by a representative of the commission that the $250,000 administrative penalty would not be enforced. The BCSC maintains that no such representation was ever made to Thow.

Williams said he had no choice but to dismiss the BCSC’s application for judgment, but did so “without prejudice to the plaintiff’s right to bring a further application.”

The BCSC said it will continue to work to renew the judgment.

“The B.C. Securities Commission is pleased with the court’s decision that our actions — prioritizing restitution to Mr. Thow's victims — were ‘eminently commendable’ and were not, as Mr. Thow contends, an ‘abuse of the court’s process,’” Brian Kladko, manager of public affairs for the BCSC, said in a statement.

“The commission will continue to move forward with this matter to get our judgment against Mr. Thow renewed so we can continue our collections proceedings against him.”

The ruling in B.C. Supreme Court comes after Thow claimed last fall that the commission’s pursuit of a $250,000 fine it levied against him 10 years ago was tantamount to an abuse of process.

Thow claimed the BCSC abused the process by taking no steps to collect the fine over the last decade, permitted interest to accrue (interest was recently calculated to have reached $80,000 as of April this year) and pushed for the payment only as a result of media and political pressure.

Late last fall, with the 10-year deadline for enforcing the judgment approaching, the BCSC filed suit for $250,000 in fines and interest Thow had not paid.

Thow had initially been ordered by the commission to pay a $6-million administrative penalty for contravening the B.C. Securities Act in 2007. That figure was later reduced to $250,000 by the B.C. Court of Appeal.

In his reasons for judgment this week, Williams dismissed as being “quite without merit” Thow’s assertion that the BCSC’s inaction on collecting the debt amounted to abuse of process.

Williams noted the decision to refrain from actively pursuing collection was “eminently commendable” given any money paid toward that debt could reduce the amount of money Thow could pay to satisfy a restitution order requiring him to pay $3.9 million to benefit victims of his fraud.

Thow was found guilty and jailed in 2010 for defrauding 20 clients of about $10 million, the total that the Crown felt it was able to prove.

At his trial, the Crown characterized Thow's actions as a classic Ponzi scheme. He took money from clients for schemes that included investing in a Jamaican bank and short-term loans for developers. He never made those investments.

The RCMP Integrated Market Enforcement Team led a five-year investigation into Thow, a former Berkshire Investment Group vice-president, based on allegations he cheated clients and friends out of more than $32 million.

Thow, who served three years in prison and was granted parole in the fall of 2012, is no longer under the jurisdiction of the Correctional Service of Canada or the Parole Board of Canada. He has been living in the Fraser Valley, where he has worked for a landscaping firm and paying $100 a month for restitution to his former clients.