Last week, we provided the foundation for the new regulations regarding KYP, or "Know Your Product." We also noted that the regulators have not specifically prescribed a format to evidence KYP, and each Wealth Advisor or Portfolio Manager is welcome to follow their own process. Below, we delve into 10 sections that outline The Greenard Group KYP process, as follows:

1) Model Portfolios

2) Investment Objectives and Risk Tolerance

3) Transfers In-Kind

4) Solicited versus Unsolicited Trades

5) Structured Products and Proprietary Products

6) New Issues and Initial Public Offerings

7) Fee Block

8) Trade Block

9) Performance Report

10) Investment Policy Statement

Section 1: Model Portfolios

One of the benefits of being a Portfolio Manager is the ability for us to run tight model portfolios of select positions. The Greenard Group’s model portfolios are: The Greenard Index Balanced Income, Greenard Index Moderate Growth, and Greenard Index Growth. All our model portfolios have an equity component. The choice of model determines the portion of the portfolio that is allocated to equities. The Greenard Index Balanced Income model has 40 per cent fixed income and 60 per cent equities. The Greenard Index Moderate Growth model has 20 per cent fixed income and 80 per cent equities. The Greenard Index Growth model has 0 per cent fixed income and 100 per cent equities.

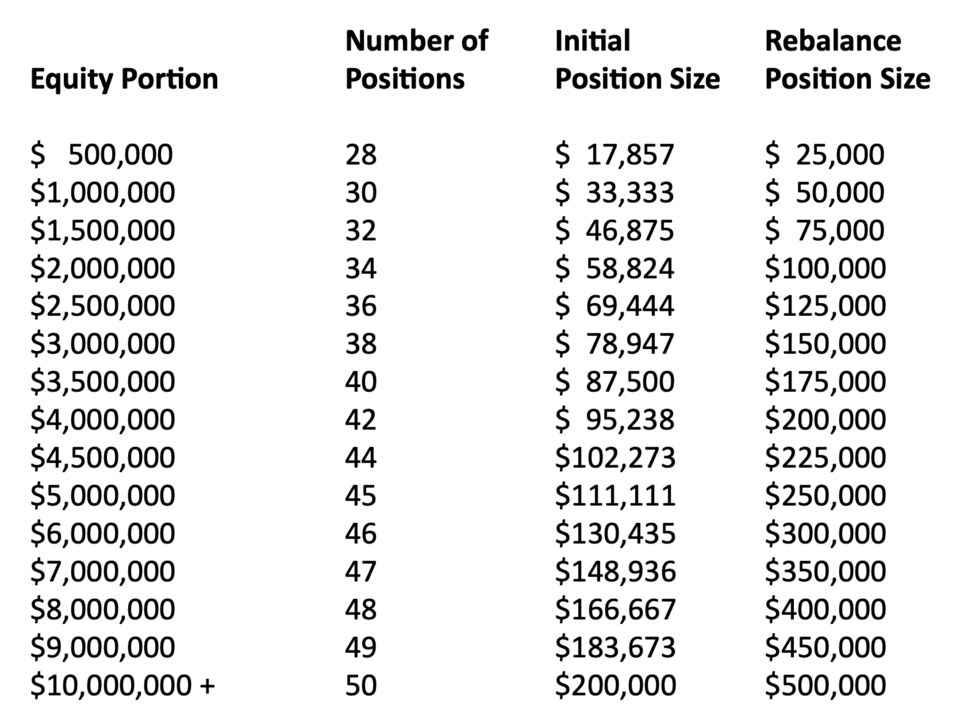

In addition to the choice of model portfolio, the size of the portfolio also has a factor on the number of holdings. We have a disciplined approach to both the number of holdings, initial position size, and rebalancing position size based on the portion allocated to equities. Below is The Greenard Group Holdings chart for the equity component:

Having a disciplined model portfolio approach naturally limits the number of securities to a maximum of 50. Our model portfolio holds all individual equities. We monitor and run our screening metrics on these direct holdings. We do not exceed the 50 positions.

When we like a security better than what is currently in our model portfolio, we will often utilize switch trades to ensure the overall number of holdings does not exceed the maximum of 50.

Section 2: Investment Objectives and Risk Tolerance

Prior to opening accounts for clients, we will have a thorough discussion about investment objectives. Investment objectives are the portion of the portfolio that is allocated to income, growth and speculative trading stated as a percentage. In most situations, we have a mixture of income and growth. Most of our clients have zero per cent allocated to speculative trading. For example, the investment objectives for a non-registered account may be 40 per cent income, 60 per cent growth, and 0 per cent speculative trading. If a client calls up and wishes to do a trade that is speculative, we first discuss investment objectives, and what has changed from our initial discussion. If after the discussion, the client still wishes to add a speculative position we must first update the investment objectives on the account. The trade would then be marked as unsolicited (see below for discussion about unsolicited and solicited).

In conjunction with talking about investment objectives, we also talk about risk tolerance. Each account has a percentage allocated to low, medium, and high risk. When we open an investment account, we will have a discussion with the client about the level of risk they would like to take with their investments. An example, an account could be set up as 20 per cent low risk, 80 per cent medium risk, and 0 per cent high risk. If a client calls up and wishes to do a trade that is high risk, we first must discuss risk tolerance and how this has changed from previous discussions. If after the discussion, the client still wishes to add a high-risk position we must update the risk tolerance on the account. The trade would be marked as unsolicited (see below for discussion about unsolicited and solicited).

Section 3: Transfers In-Kind

When we do proposals for new clients that have their investments at another financial firm, we will often recommend that they transfer all their existing investments in-kind (exactly how they are). Once the transfer is completed, we then meet to discuss what holdings to hold and which holdings to sell. We will look at the structure of where the investments are held, the tax consequences for selling (if any), and if the client has a strong preference for holding a particular position that is not currently in our model portfolio. The longer-term strategy is always to get the holdings positioned correctly and aligned to our model portfolio.

Section 4: Solicited Versus Unsolicited

Solicited trades are transactions that we have recommended to our clients. When we enter the trade, the confirmation slip will be marked “solicited”. An unsolicited trade is when a client contacts us and instructs us to purchase a security in their account on their behalf. With unsolicited trades, the confirmation slip will be marked “unsolicited”.

As a Portfolio Manager most of our trades are done as block trades. We will add up the total shares of a company in all our clients’ managed accounts and sell them as one block. We may have a switch trade recommendation where the funds from a sell are immediately allocated to another holdings that we feel has a better risk adjusted returns.

If a client calls us up and wishes to purchase a security that we like, but is not currently in our model portfolio, it is still marked as unsolicited. These types of trades have an impact on the overall portfolio as it means one of two things, the cash allocated to the unsolicited trade is not being utilized to purchase a security that is in our model portfolio, or the positions sizes of each holding is not aligned.

If a client calls us up and wishes to purchase a security that we do not follow, we will advise the client that we do not follow the security and do not advise that they add it. As Portfolio Managers we can decline to do a trade if we believe it is unsuitable for the client – this is especially the case if the trade is speculative and high risk. If the frequency of these types of trades is high, we will recommend that the client open a self-directed account that they can do these types of purchases in.

Section 5: Structured Products and Proprietary Products

We do not hold any structured products with The Greenard Index model portfolios. Risk is often higher, liquidity can be an issue, fees can be higher (many of which are embedded). Structured products are a general term that is used to describe financial products that have been pre-packaged. This package may hold a basket of securities, debt products, options/derivatives, commodities, foreign currencies, etc. In our opinion, these structured products are often more complex than the average client would understand. Below are the general categories of structured products:

• Interest Rate Linked

• Floating Rate and Inverse Floating Rate

• Principal Protected Note

• Foreign Exchange Notes

• Commodity-Linked Notes

• Closed-End Funds

• Hedge Funds

• Accredited Investor Products

• Market Linked

• Open-End Mutual Funds

• Straight Exchange Traded Funds (ETFs)

• Leveraged Exchange Traded Funds (ETFs)

• Long/Short Exchange Traded Funds (ETFs)

• Alternative investments

Not only is the level of complexity of the product greater, but there are also hundreds of financial firms issuing and marketing structured products.

Section 6: New Issues and Initial Public Offerings (IPOs)

As a Portfolio Manager, we are not permitted to purchase new issues or IPOs in a managed account. The reason for this is that Portfolio Managers have a fiduciary responsibility to always act in the best interests of clients and a fee agreement is reached at the beginning of the relationship. There is an obvious conflict of interest if a Portfolio Manager were to charge a fee and then also recommend products that paid additional compensation on top of this.

A new issue is when an existing publicly traded company issues either debt or equity. An initial public offering, also known as an IPO, is when a previously private company goes public for the first time by issuing shares. New issues and IPOs have been the bread and butter for many financial professionals. New issues are far more common than IPOs. Typical selling commissions for these can range from two to five per cent. Typically, the client would not pay commissions for purchasing these. The issuer of the new issue or IPO will pay the commission directly to the Wealth Advisor. Wealth Advisors have an obligation to disclose the selling commission that they are receiving. If you receive a call regarding a new issue, they should also be telling you the compensation they will be receiving. The underlying investment is negatively impacted price wise by the amount of compensation paid to the underwriters and Wealth Advisor. The offering document on just one structured product would take hours to read through the prospectus and fully understand the product.

One of the higher risk type new issues are called a flow-through investment. They are typically issued by small mining companies and the government issues tax credits. A Wealth Advisor who recommends a flow through investment will typically receive a selling commission. The underlying investment is considered high risk and are not suitable for most clients. They are illiquid for a period, and nearly always drop materially in value during the holding period.

Section 7: Fee Block

Whenever a client does an unsolicited trade that we feel is high risk or speculative we will have a discussion with the client about KYP and how as a Portfolio Manager we do not have the capacity to effectively monitor every security. If we have this discussion about a particular security, we will fee-block the position so we do not charge a fee on a position that we can not effectively follow. In our opinion, if a Wealth Advisor or Portfolio Manager charges a fee for holding a position, they should have some obligation to monitor the position and provide advise to the client.

Section 8: Trade Block

We have specific procedures we do when a client chooses to do an unsolicited trade to purchase a security, or requests that they hold onto a security that has transferred into the account (from an in-kind transfer). The procedures are first to have a discussion with the client regarding what happens internally within our team. As we did not recommend the position, we will put a trade block on the position, meaning that the position can not be sold without a warning on our trading system popping up. This is to ensure that we do not inadvertently sell the position that the client wishes to hold. We advise the client that we will be putting a trade block on the position and the only way the position will be sold is if the client instructs us to sell it. We also advise the client that if a position is purchased against our advice, we do not provide advice with respect to when to sell the security.

Section 9: Performance Report

Prior to doing unsolicited trades and holding positions that are not in our model portfolios, we will discuss the reporting of performance numbers. When a client calls us up and wishes to purchase a security that we do not recommend, and is not part of our model portfolio, we will advise them that this will impact the performance reports. At the end of the year, if both solicited and unsolicited trades occurred, the performance numbers will not equal the performance numbers of our model portfolios.

Section 10: Updating Investment Policy Statement (IPS)

One section of our client’s IPS is called Unique Preferences. If a client chooses to have holding(s) that are not within our model portfolios, we may document this within Unique Preferences. This is especially the case if we feel the position is speculative or high risk. Even when positions are within our model portfolio, we may document situations where a client chooses to have an excessive position size (greater than five percent of the portfolio) in one ore more holdings.

In conclusion, you can imagine how many positions a Wealth Advisor would have to monitor if every month they purchased structure products, participated in new issues and IPOs, received unsolicited trade requests, transferred investments in-kind for new clients, etc. Multiply the effect over a multi-year career, a Wealth Advisor may have dozens and dozens of smaller holdings. These same Wealth Advisors are going to have to explain to regulators how they plan on monitoring that many holdings.

Kevin Greenard CPA CA FMA CFP CIM is a Senior Wealth Advisor and Portfolio Manager, Wealth Management with The Greenard Group at Scotia Wealth Management in Victoria. His column appears every week at timescolonist.com. Call 250-389-2138, email greenard.group@scotiawealth.com, or visit greenardgroup.com.