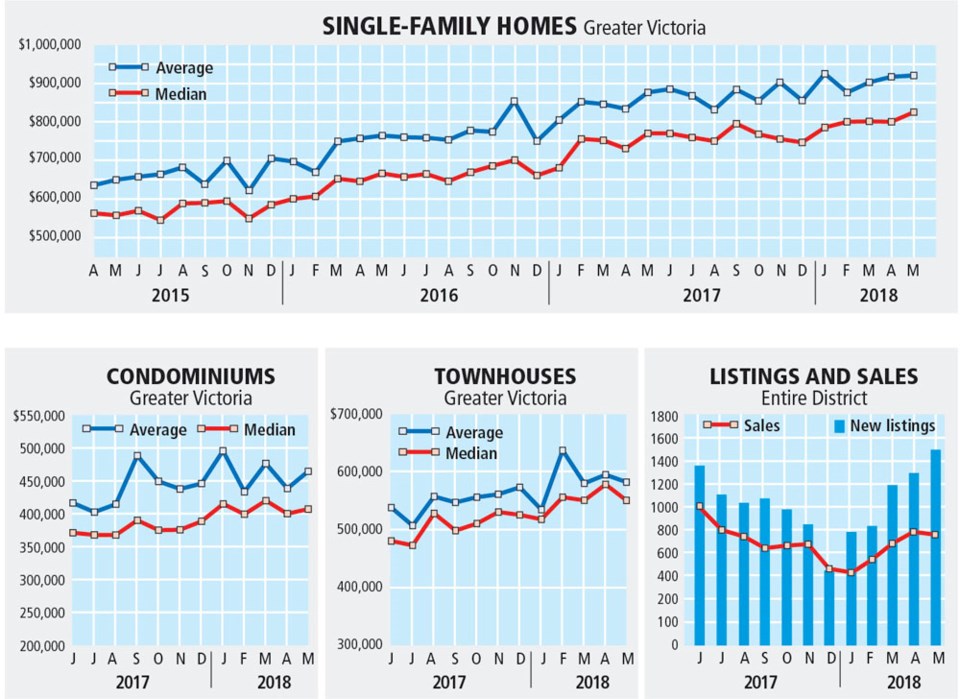

Greater Victoria’s real estate market is changing as several factors create new scenarios for sellers and buyers. That was evident as overall sales numbers declined in May, and a record-high benchmark price was set for a single-family house in the core.

Selling prices for single-family houses in the region’s core continue to march up, and more homes are priced at $1.5 million or more.

At the same time, there are fewer houses priced at less than $750,000 — setting the stage for tougher competition in that sector.

The new benchmark for a single-family house in the core was $878,100 last month, up from $820,800 a year earlier, the Victoria Real Estate Board said Friday.

A benchmark refers to a typical house in an area; the core area covers Victoria, Saanich, Oak Bay, Esquimalt and View Royal.

The total number of real-estate sales in Greater Victoria slid by 25 per cent in May to 755, down from 1,006 a year ago.

Greater Victoria’s real estate market has changed in the past 12 months, said Kyle Kerr, Real Estate Board president.

“We are in an interesting time here,” Kerr said. “We are seeing different levels of price pressure and price relief in micro-climates of our area.

“You may find more flexibility if you are shopping for a multi-million-dollar estate in certain areas. You may be in for a competition if you are shopping for a lower-priced home or condominium.”

The capital region’s housing market has one-third fewer single family houses for sale compared with a year ago, he said.

“We are seeing pressure from increased competition on a smaller number of homes, which is really pushing the under-million-dollar market,” Kerr said.

The total number of properties for sale was listed at 2,394, up by 26.3 per cent from May 2017.

As prices moved upward, the number of homes priced at $1.5 million or more rose by nearly 50 per cent compared with last year.

Kerr said many buyers have seen their purchasing power diminished as federal mortgage-qualification rules tightened up.

He also pointed the finger at B.C. taxes, which he said are putting pressure on “high-value home owners.”

Taxes include B.C.’s new speculation tax, a higher school tax for properties assessed at $3 million and up, and the new-to-Victoria foreign buyer property transfer tax.