The annual B.C. ShakeOut earthquake drill is scheduled for next Tuesday.

The annual B.C. ShakeOut earthquake drill is scheduled for next Tuesday.

If you really want to get into the spirit of this thing, check your earthquake insurance policy.

You’ll be shaking your head.

After Victoria’s last reminder quake 10 months ago, which felt like a big truck roaring past the house, I activated my personal quake-response protocol: Ran down to the basement and drank all the water in the emergency kit. Then gazed at social-media feeds on the phone, waiting for the government to help me.

A later review of my earthquake insurance triggered a major aftershock.

The policy, which costs hundreds of dollars, had an unusual number in it I hadn’t noticed before. As in, a $38,400 deductible on the house itself. And another $9,000 deductible on personal property.

If a quake ever flattens the joint — and the wording is quite precise that it has to be the actual moving of the earth that does the damage — I’ll need to come up with $47,400 before the coverage kicks in. Even more aftershocking, the deductible has doubled in the past five years. It was $23,000 in 2011, when the premium was about $100 cheaper.

One of the explanations offered for those hikes is that the science is getting more precise in terms of predictions. But the increases coincide with a steady increase in awareness about the danger of an earthquake. The more concern grows, the more the insurance industry feels the need to protect itself from the catastrophic financial impact of the Big One. It’s an expensive feedback loop.

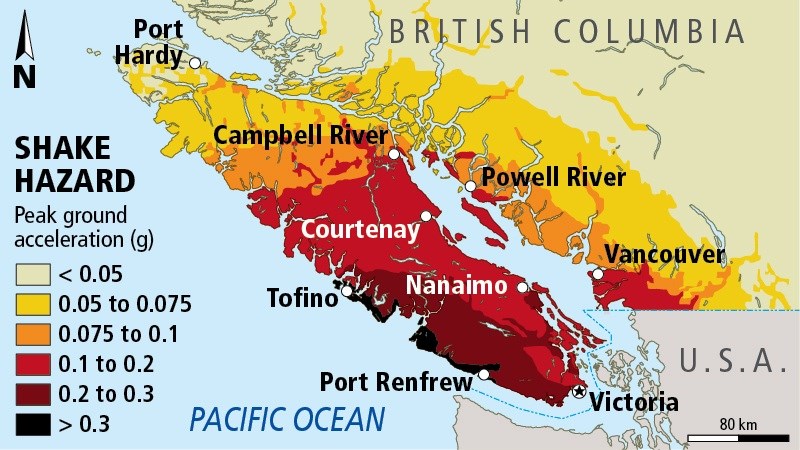

The Insurance Bureau of Canada appeared before the legislature’s finance committee recently to further the awareness effort. The central finding they cite is the prediction of a 30 per cent chance of a major earthquake on the coast in the next 50 years.

“It’s something, I can tell you, that keeps our industry’s CEOs up at night and dominates our board discussions, because we know that the impacts of such an event would be massive,” said official Aaron Sutherland. “I’ll be frank with you. If there is a cataclysmic event, something like we saw at the Fukushima earthquake … no amount of money is going to be able to shore up that kind of event.”

Insurers are required by federal regulations to have enough reserves to cover a one-in-500-year earthquake, which equates to a 9.0 off the coast. So the industry has $35 billion in reserve. It’s considered enough to cover, through reinsurance, all but the most remote likelihoods. Insurers have to pay out everything they have, then if one goes bankrupt, others step in, until the well runs dry.

“At that point, we’ll be looking around for assistance.”

A cataclysmic event beyond $35 billion would stretch insurance to the snapping point. The bureau is working on getting the federal government to commit to a loan of last resort to backstop the industry.

The dire warnings stand even though only 45 per cent of British Columbians have earthquake insurance. Sutherland said it’s about 70 per cent in high-risk Island areas. The numbers fluctuate, ticking up a bit after minor seismic events, then levelling off.

As a comparison, New Zealand has a different approach that results in about 90 per cent coverage. There were 170,000 building claims after the Christchurch 6.3 earthquake in 2011, according to the central bank. Insurers have paid out $26 billion to date, and they’re still not fully settled. The bank said earthquake premiums tripled the year after the quake.

The bureau gives B.C. good marks relative to the rest of the country for earthquake preparedness and awareness. But it’s still going to be expensive if the unthinkable happens. The bureau’s modelling of a true cataclysm on the West Coast puts insured losses at $20 billion and overall economic loss at $75 billion.

Conjuring up the personal ramifications is what sells earthquake insurance. I’ll still keep buying it, if only out of the conviction that it will hit the day after I cancel.

You don’t need it until that one day in 500 years actually happens. But then you really need it.