The B.C. Finance Ministry is expected to release another update this week on foreign buyers of real estate.

The B.C. Finance Ministry is expected to release another update this week on foreign buyers of real estate.

The data released so far has been skimpy and hard to compare when it comes to reaching conclusions. But the early indications from another four weeks of information, specifically on the 15 per cent surtax on foreigners buying Metro Vancouver property, are that it’s doing what it was intended to do.

It is contributing to curbing the runaway prices. The market is chilling out to some extent, which gives vendors and buyers more time to consider decisions.

And contrary to what some people feared, the tax is not refocusing foreign buyers’ attention to other regions, to the detriment of those local markets. The Victoria section of the upcoming report is expected to show little change month-to-month. And the federal government’s tightening of mortgage eligibility is expected to calm the market still further.

The government gave itself the option of widening the coverage area beyond Metro Vancouver if unintended consequences developed after the tax kicked in Aug. 2. That looks unlikely now.

Several analyses have concluded that the real estate market started slowing several months before the foreign-buyers tax was abruptly imposed with one week’s notice. That notice period covered the last week of July and started a stampede to close deals before the tax kicked in. “Mass panic” was one of the headlines during that frantic week, the busiest ever at the land titles office. That surge in turn skewed the interpretation of the July-to-August comparison on real-estate numbers.

The last report from the Finance Ministry was Sept. 22 and found foreign investment accounted for nearly six per cent of 48,000 deals over six weeks ending Aug. 31. In Metro Vancouver, foreign buyers accounted for 9.3 per cent of 22,000 deals. That’s more than twice as high as the foreign share of the capital region’s market (3.9 per cent).

Whatever panic there was stayed confined to Metro Vancouver. And it has subsided over the 11 weeks the tax has been in effect. The more prevalent mood now is uncertainty, driven by a drumbeat of news and reports that sales are dropping and prices are expected to follow suit, if they’re not doing so already.

Meanwhile, the last summary from the Victoria real-estate industry showed 781 sales in September. That’s up 11 per cent from the previous September, but down about the same percentage from August.

Inventory levels have slumped dramatically through most of the past year, with 41 per cent fewer properties on the market at the end of September, compared with the previous September. It’s the fewest properties on the market in any month over the past 20 years.

The relative lack of listings is what’s keeping prices high, to the point where benchmark prices this year will likely break records. But some consider it the final hurrah before the full impact of the foreign-buyers tax and the tighter federal mortgage rules kick in, and drive prices down.

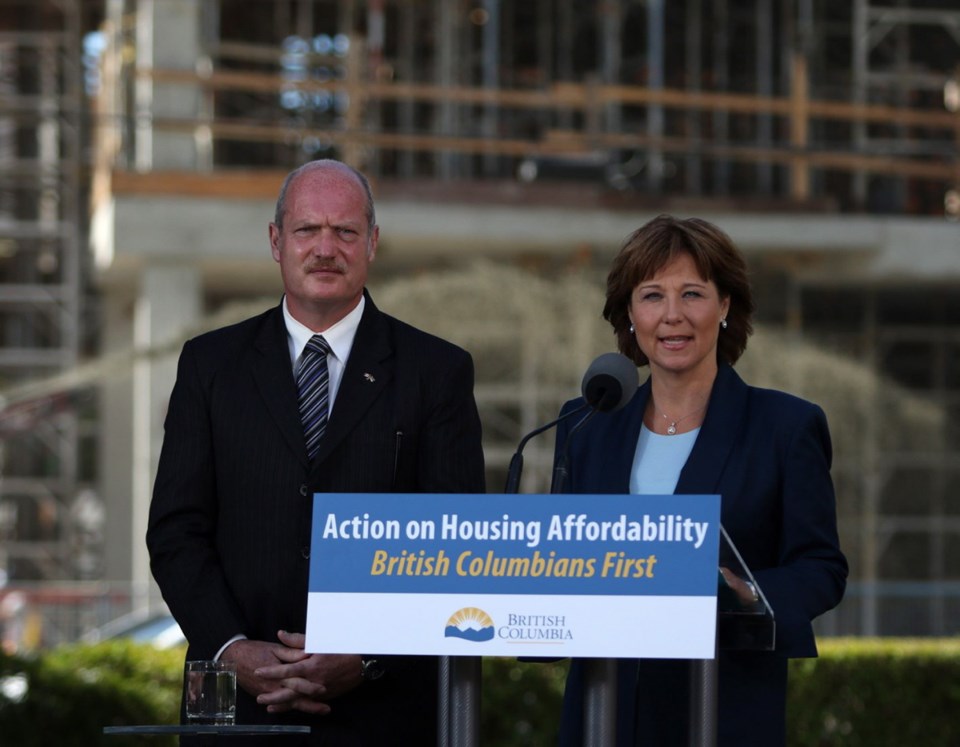

That was the B.C. Liberals’ basic political goal when they introduced the tax. Finance Minister Mike de Jong said at the outset in July that concern and consternation about real-estate prices were prompting economic and social questions about what was driving them.

“This is a significant intervention into the marketplace,” he said. “It is intended to take effect in a matter of days. There’s no question that that is going to cause some consternation in terms of contracts that are in place now, yet the situation we are confronted by, in the government’s view, deemed it appropriate to move.”

It was a win of sorts for the NDP Opposition, which had goaded the government into acting. Housing critic David Eby responded by welcoming de Jong to the conversation more than a year late. The NDP pivoted slightly during debate away from foreign ownership and toward owners of vacant homes as the source of the problem.

The government’s course change was a calculated gamble to find the sweet spot between collapsing the market and reining it in without evaporating too much equity.

It looks as if they’re in that zone, barring a sudden delayed reaction.