People with cottages and second homes on the Gulf Islands or in rural areas will not pay the speculation tax, Finance Minister Carole James announced Monday in response to concerns from British Columbians that the new tax would cost them thousands of dollars.

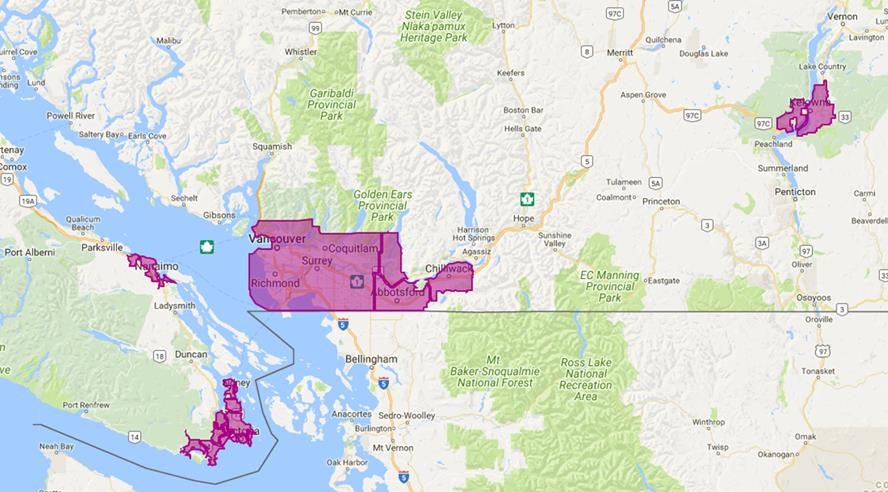

James also announced changes to the geographic areas where the tax will apply, removing Parksville, Qualicum, unincorporated Gulf Islands and the Juan de Fuca electoral area.

“People with cottages at the lake, or cabins, or the islands, will not pay this tax. People with second homes outside of high-cost urban areas will not pay the tax.”

More than 99 per cent of British Columbians will not pay the tax, James said. “Only those who own multiple properties and leave them empty in major cities will be asked to contribute,” James said.

Murray Hamilton, the strata property manager for about 400 cottages around Horne Lake, said owners breathed a sign of relief after hearing Monday that Parksville and Qualicum are no longer in the speculation tax area. “It’s very good news. Owners are very relieved.”

The strata includes at least a dozen owners from Alberta, the United States and some former Island residents who have moved to take jobs overseas but maintain a vacation home. Those residents were very concerned about the tax, Hamilton said.

“It’s very unfortunate how [the NDP government] announced it without thinking through the details,” he said. “They rushed it, they didn’t have the facts.”

The government is “making up taxes by trial and error,” said Liberal Opposition leader Andrew Wilkinson. There’s no clear picture of the boundaries in which the tax applies, he said. “The rules keep changing. What they’re doing with these artificial boundaries and changes to these boundaries, it’s creating a lot of uncertainty.”

That uncertainty could spook the housing market into a complete slowdown, Wilkinson said, which could be counter-productive in increasing the housing supply in B.C.

Wilkinson said a traditional capital gains tax is the best way to deal with real estate speculators.

“What they’re saying to people is ‘Give us part of your assets, give us part of your savings.’ And that’s not the way taxation has ever been done in Canada.”

The speculation tax, based on a percentage of property value and to be paid annually, will still apply to Metro Vancouver, the Capital Regional District (excluding the Gulf Islands and Juan de Fuca), Kelowna, West Kelowna, Nanaimo-Lantzville, Abbotsford, Chilliwack and Mission.

“We have focused the geographic areas so this tax only applies in urban housing markets hardest hit by this crisis,” James said.

The highest rate of two per cent of assessed property value will apply to foreign owners. Canadians and permanent residents not living in B.C. will pay one per cent. British Columbians who are Canadians or permanent residents with second homes in major urban centres will pay 0.5 per cent.

Second homes worth less than $400,000 or properties which are rented out at least six months of the calendar year in increments of at least 30 days will be exempt from the tax.

Homeowners can apply for an exemption based on “special circumstances,” James said. This could include seniors moving into a long-term care facility or people who inherit a property after a death in the family.

People who own condos who are barred from renting due to strata rules will be grandfathered in, James said.

The Nanaimo Regional District had asked to be exempt from the speculation tax, amid fears the tax will hinder the region’s efforts to build more affordable housing.

Kim Smythe, president of the Greater Nanaimo Chamber of Commerce, is disappointed the tax will still apply to Nanaimo and Lantzville.

“We’re not a major urban centre, we’re not Victoria or Vancouver,” he said. “You won’t have developers building more houses here if you drive [property] values down.”

Casey Edge, executive director of the Victoria Residential Builders Association, said even with the changes outlined Monday, the tax is wrong-headed and has led some developers in Greater Victoria to put the brakes on new housing developments.

“This is a haphazard way to address affordability,” Edge said, adding that in the CRD, the lack of a regional transportation plan is one of the biggest barriers to affordability.

The tax is projected to bring in $200 million in revenue each fiscal years and James said she doesn’t expect the changes outlined Monday to drastically change that figure. Any change in revenue would be covered by contingency funds, she said.

The speculation tax was rolled out in the February budget and was sold as a way to stop foreign speculators from using the hot housing market as a stock market. The proposal came under intense criticism from the Liberal Opposition who accused the government of punishing British Columbians with second homes or inherited cabins.

- - -

B.C. Finance Ministry statement on changes to speculation tax, March 26, 2018