About 3.3 per cent of B.C. residential property transfers during a 19-day period in June went to foreign nationals, the majority from China, the provincial government said Thursday.

The percentage covered June 10 to 29, and was part of the first release of information from an amended property transfer tax form.

Opposition party leaders said the reported percentage is too low and not a true reflection of the impact foreign buyers have on the B.C. housing market.

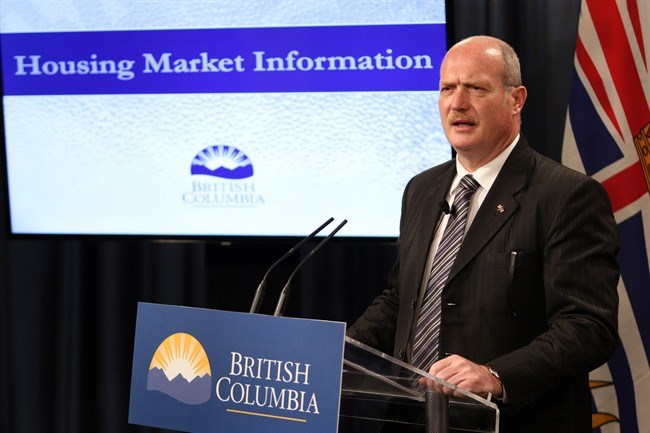

B.C. Finance Minister Mike de Jong brought in measures in the February budget to track the role of foreign ownership amid claims that foreign buyers affect affordability and vacancy rates. Last month, the government amended property transfer tax forms to collect data about the citizenship and country of origin of people buying real estate in the province.

In the 19 days provincewide, there were 10,148 transactions valued at $7.6 billion; 337 involved foreign buyers, and were worth $390 million, or 5.1 per cent of the total value. The majority of transactions were in Metro Vancouver — 50.4 per cent.

In the capital region, there were 17 property transfers to foreign buyers, or 2.3 per cent of the 737 total transactions.

Foreign purchases accounted for $12.5 million in capital region sales value, which is three per cent of the $422.9 million in total real estate transactions.

NDP Leader John Horgan said offshore buyers are snapping up homes as safety deposit boxes for wealth while British Columbians are shut out of the real-estate market. The party wants non-resident property owners to pay a 1.5-per-cent real estate surcharge. “We want to tax those who are coming in based on greed rather than a desire to live and work in British Columbia,” Horgan said.

De Jong said the limited data collected by the province is relevant in showing that foreign buyers are driving escalating housing prices and that he didn’t want to wait months before providing the information. “We know that for the period that we studied foreign nationals are purchasing at higher values than the average Canadian citizen.”

He said there are penalties for lawyers who provide false information on land title forms on behalf of their clients.

De Jong said he will report data on foreign buyers every month.

B.C. Green Party Leader Andrew Weaver said the government is not collecting relevant real estate data. Speculation in B.C.’s real estate market is largely taking place in transactions that do not reveal the identity of buyers, he said.

For a wealthy purchaser, “I don’t buy a property in my name, I buy a property in a trust and then I have a corporation own the shares in the trust. “But when I sell that property, I’m not changing title on the property, I’m selling the shares in the corporation.

“So I don’t pay any property transfer tax and there is no record of change on title, so government has no data.” That is a “loophole to allow people to avoid paying property transfer tax” and leads to speculation, he said.

The data that is needed is how often there has been a transfer of beneficial ownership of properties, whose title is registered in a bare trust, Weaver said. “This is what is done in Ontario. They actually closed this loophole in Ontario.”

Beneficial ownership refers to someone who has the property rights or ownership and the title to that property is in another name.