Another month of low inventory has led to another slow month of sales — and higher prices — for the region’s real estate market, according to figures released Monday by the Victoria Real Estate Board.

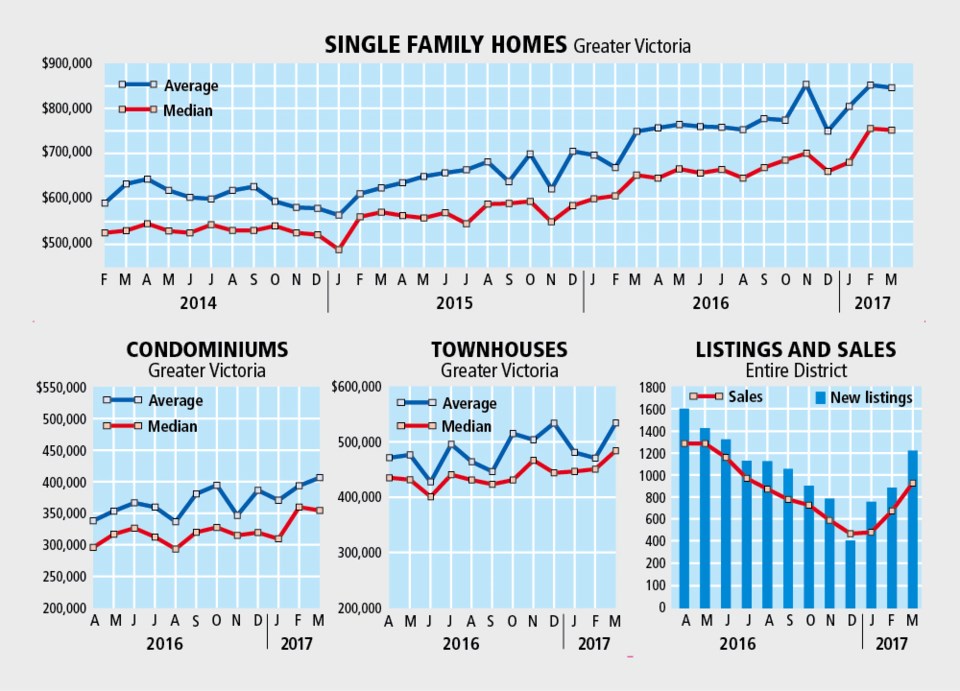

There were 929 properties sold in March, a 17 per cent drop from the 1,121 sold last March, although that sales figure was still a 37 per cent improvement from the 675 sold in February this year.

“We predicted early in the year that we wouldn’t see a continuation of the record sales numbers that we saw in 2016,” said Ara Balabanian, president of the VREB. “However, we are still in a very active market, as evidenced by the fact that this is second-highest March on record if you remove that record-breaking 2016 data.

“We saw nearly 200 more transactions last month than March 2015, when 734 properties sold.”

Still, there were just 1,556 active listings at the end of March, a 40 per cent drop from the 2,618 available at the end of March last year.

The low inventory levels and continued strong demand to get into the Victoria market appear to have resulted in more price increases.

According to the real estate board, the benchmark value for a single family home in Greater Victoria last month was $652,700, up from $552,800 in March of last year.

In the Victoria core, the benchmark price last month was $790,100, a big jump from the benchmark price of $663,300 in March of last year.

The benchmark price of a condominium in the capital region was $339,900 last month, up from $322,500 at the same time last year.

There may not be much relief in sight. Homebuilders have said they expect a slower year this year with about 2,000 new housing starts, down from the 2,933 they started last year.

And while there are 1,600 new condominium units expected to be out of the ground in the next 18 months, demand and pre-sales should snap them up quickly.

Real estate agent Ron Neal, owner at Remax Alliance, said solutions to the lack of housing might come from government, perhaps offering incentives for developers to create more affordable housing.

“It's the lack of supply that is our problem. People want to live here. We have jobs, climate, lifestyle that attracts people to relocate here from the rest of Canada and around the world,” he said. “We have more than 3,000 more people every year who choose to move to Greater Victoria — they need to live somewhere.”

Bobby Ross, a real estate agent with Pemberton Holmes, suggested more rezoning of larger lots to offer more density could be an answer.

“That would in turn bring on more inventory. However, under the current market conditions, as long as demand remains high, inventory levels will remain low,” Ross said.

Balabanian said the market is a new reality.

“The public and [real estate agents] are getting used to the new tempo of the market — with the ongoing historically low inventory levels and high consumer demand — both parties need to be tenacious and have quick reflexes,” said Balabanian, though he was quick to note that if not priced appropriately, homes can still sit unsold for months.

“We do think we will see a more balanced market in the future as more inventory becomes available,” he said. “Traditionally, people prefer to list their home when gardens and outdoor areas can be shown to their best advantage.”

The low inventory blues are also being sung north of the Malahat, said the Vancouver Island Real Estate Board. According to its March numbers, released Monday, there were 484 single-family homes sold last month, a drop from the 518 sold last March.

Inventory of available homes was also down, dropping 36 per cent to 1,023 active listings available last month compared to 1,598 one year ago.

“Properly priced single-family homes between $500,000 and $600,000 rarely last longer than a day or two and generate multiple offers, with many selling above list price,” said Janice Stromar, president of the Island board.

According to the British Columbia Real Estate Association, strong economic fundamentals are fuelling housing demand throughout the province.

The association noted an economy that continues to outpace the rest of Canada, increased interprovincial migration and strong job growth have been the forces driving the market.

Prices have also increased in the VIREB’s area, which is everything north of the Malahat on the Island.

The benchmark price of a single-family home was $410,400, up 17 per cent from one year ago.