Don’t say B.C. Assessment didn’t warn you.

True to its word, B.C. Assessment has released assessment notices for the 360,000 properties across Vancouver Island and, as a result of a strong real estate market, most property owners are seeing a significant jump in the value of their land.

Greater Victoria homeowners were given a heads-up last month that single-detached homes in some areas could see an increase in assessed value as high as 40 per cent.

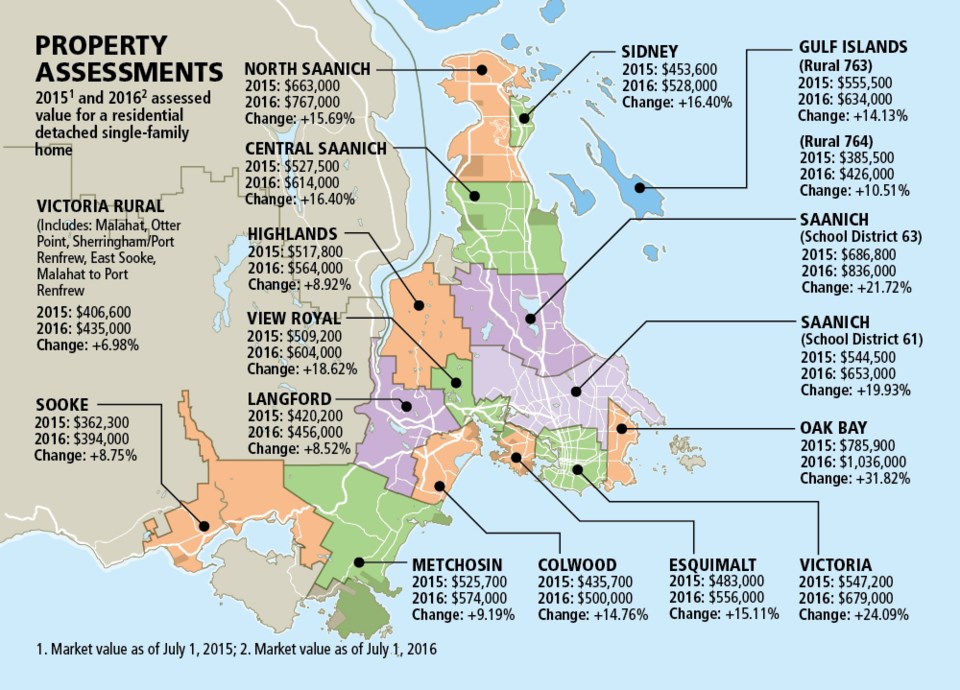

The data released today shows single-detached homes in Greater Victoria have increased in assessed value by between five and 40 per cent. Condos and townhomes have increased by between five and 30 per cent while commercial properties are up five to 15 per cent and industrial properties have jumped as high as 10 per cent.

Oak Bay saw the biggest jump in value, as the average home saw a 31.8 per cent increase in its assessment to $1.04 million.

The City of Victoria also saw a significant jump in values as the average single-family home increased in value 24.08 per cent to $679,000 compared to last year’s assessment, while Saanich saw an increase of 21.7 per cent to $836,000 for a typical home in its northern area and a 19.9 per cent increase to $653,000 in its southern region.

Across the board, all parts of the capital region saw increases in single-family homes this year.

“The majority of residential home assessments within the region are shifting between plus-five per cent to plus-25 per cent compared to last year’s assessments,” said regional assessor Tina Ireland. “A robust real estate market over the past year resulted in assessment increases for many properties in the Vancouver Island region, most notably those in the Greater Victoria areas which have indicated increases up to 40 per cent.”

The assessment notices, which homeowners should receive within the next few days, show the estimated market value as of July 1, 2016. The value takes into account a variety of factors including nearby sales, size, age, quality, location, condition, view and improvements.

The assessment value helps determine how much homeowners pay in property taxes, although an increase does not necessarily mean a similar rise in taxes. Higher tax bills are more likely if an assessed value is beyond the average in a municipality.

The most valuable Greater Victoria property is once again James Island, which is valued at $53.28 million, up from $51.62 million last year.

The most valuable condo on the Island is at 2101-83 Saghalie Rd. in the Bayview development on Songhees, which came in at $6.86 million this year.

Topping the list of commercial properties on the Island was Uptown Shopping Centre, which is valued at $369.9 million, up from $310.8 million last year.

The top industrial property on the Island this year is Catalyst Paper’s Crofton mill, which is valued at $125.4 million.

Provincewide, there are now more than two million properties on the assessment roll. The value of all those properties is $1.67 trillion, a 25 per cent increase over last year.

Once again, the most valuable single-family home on the roll is Lululemon founder Chip Wilson’s Kitsilano home, which is now valued at $75.8 million, up from $63.87 million last year.

Vancouver Island properties have a total value of $193.2 billion, an increase of more than $20 billion over last year. Nearly $3 billion of the region’s updated assessment roll is due to new construction in the last year.

While B.C. Assessment noted more than 98 per cent of property owners accept their assessment without an independent review, appeals do remain a possibility.

“Property owners can find a lot of information on our website including answers to many assessment-related questions, but those who feel that their property assessment does not reflect market value as of July 1, 2016 or see incorrect information on their notice, should contact B.C. Assessment as indicated on their notice as soon as possible in January,” said Ireland. “If a property owner is still concerned about their assessment after speaking to one of our appraisers, they may submit a notice of complaint by Jan. 31, for an independent review.”

Property assessment review panels, independent of B.C. Assessment, are appointed by government and meet between Feb. 1-March 15.

B.C. Assessment can be reached at 1-866-825-8322. On the web: bcassessment.ca