Greater Victoria’s real estate market got off to a slow start in January, but it may not set the tone for the rest of the year, according to the new chair of the Victoria Real Estate Board.

Graden Sol, who stepped into the role for 2023, said despite low sales figures real estate agents have been reporting a thread of optimism running through buyers and sellers.

“If you’re looking at the statistics, this January was one of the slowest we’ve seen on record. However, we did see a mid-month surge in activity as buyers seemed to regain confidence after the rapid interest rate increases of last year,” he said. “It may be that consumers are moving past the market shock of the rate increases and economic uncertainty and that our market is regaining its equilibrium.”

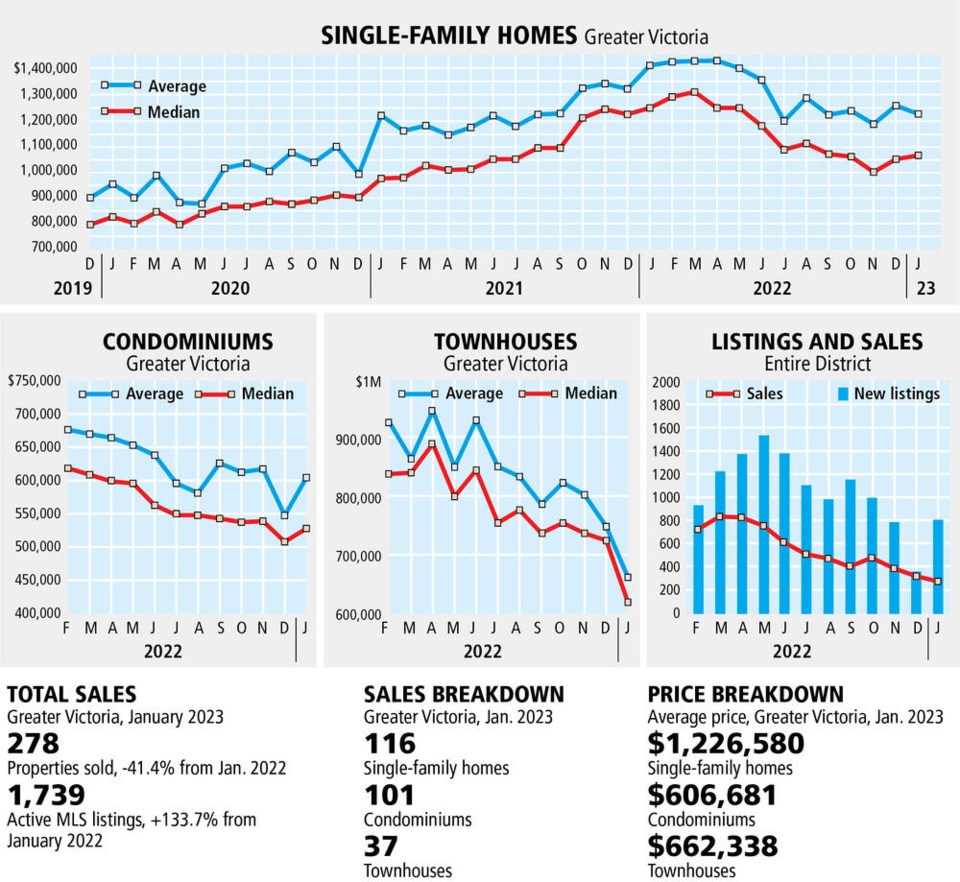

That would take some doing considering the region posted just 278 property sales in January, a 41.4 per cent drop from the 474 sold at the same time last year. It was also a 13 per cent drop from the number of sales recorded in December.

The biggest drop was in the condo market, which saw a 46.3 per cent slide to 101 units changing hands, while the number of single-family homes that changed hands fell by 33 per cent versus last January.

In fact, the 278 total sales recorded last month was the lowest number of transactions recorded since 2009 when January sales totalled 240 in the midst of a global economic collapse. It is also well off the 10-year average of 427 sales for the month.

The most properties ever sold in January was 646 in 2021.

Fewer sales, coupled with an increase in inventory appears to have had an effect on single-family home prices, as the region saw a drop in both the benchmark price of a home and the median sales price.

There were 1,739 homes listed for sale at the end of January, compared with 744 at the same time last year.

The board’s benchmark price for a single-family home in Greater Victoria dropped in January to $1.117 million from $1.159 million in January 2022, while the median sale price dropped to $1.065 million from $1.25 million last January. The board believes the benchmark price provides a more accurate value for homes in the region.

The benchmark price of a condominium in the region, on the other hand, rose to $569,900 in January, up from $552,900 a year ago, while the median sale price dropped to $530,000 from $603,420.

The benchmark price of a townhouse also rose in January to $785,100, up from $765,000 12 months earlier, while the median sale price dropped to $620,000 from $861,250.

Sol noted the direction interest rates take, inventory levels and the economy will ultimately dictate what the spring market looks like.

Sol said there is still a segment of the market that remains in great demand. “Despite the slower start to the market in January, and our constrained inventory levels, some consumers still found themselves in multiple-offer situations, particularly on the types of properties that represent the crucial missing-middle segment of our market,” he said. The City of Victoria’s approval of a missing-middle housing policy last week is a step in the right direction, he said.

“But this is one step in a marathon of work to be done to increase housing opportunities to meet our community’s short- and long-term needs,” he said. “Each municipality must keep their focus on adding gentle density where they can so that we do not face another swift increase in values when our market demand increases again.”

>>> To comment on this article, write a letter to the editor: [email protected]