Greater Victoria residential sales dropped in January, probably because buyers were signing deals late in 2017 to beat new mortgage rules, said the local real estate board.

“We expected January to be a bit slower after the increase in activity we saw in November and December, which was likely due in part to buyers entering the market early to avoid the new mortgage stress test,” Kyle Kerr, Victoria Real Estate Board president, said in a statement Thursday.

The stress test was imposed by the federal government on Jan. 1. It applies to borrowers who have taken out uninsured loans in order to ensure they would be able to cope financially if interest rates rise. Kerr said the full effect of the stress test has yet to be seen because many people lined up 90- to 120-day pre-approval prior to the test coming into effect.

“We won’t know how much that stress test will affect the spring market until we see the numbers, and spring is also the time when sales traditionally pick up.”

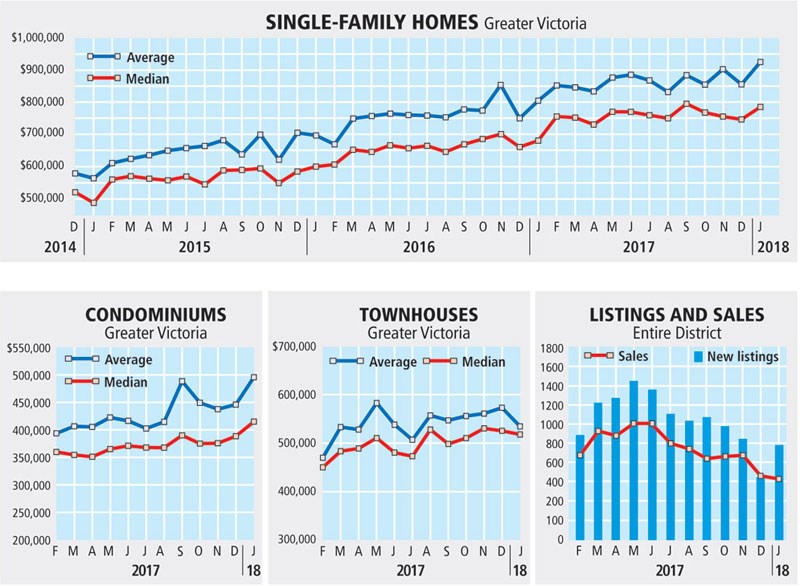

Continuing tight inventory levels are maintaining pressure on prices, Kerr said. He speculated that more government involvement in the market may take place when the next provincial budget is released. Kerr called on local governments to consider the impact of measures such as stress tests and interest hikes “before introducing further restraints on our market.”

The Vancouver Island Real Estate Board, covering the area north of the Malahat, said that January’s performance returned to normal levels after a busy December. Last month saw a year-over-year increase in sales numbers, but they were lower than December’s 327 sales.

A total of 290 single-family homes sold through the Multiple Listing Service in January, compared with 244 the same month last year. The number of properties for sale in that region has tightened up. A total of 749 single-family homes were listed in January, down by 16 per cent.